- Aprile 26, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Acumen Pharmaceuticals (ABOS)

Acumen, a biotech firm focusing on developing new treatments for Alzheimer’s disease. Alzheimer’s is a devastating illness that affects the memory of patients, ultimately leading to a loss of their ability to function independently. There is hope on the horizon, however, and Acumen is part of it.

New drugs have slowed down the progression of Alzheimer’s, and Acumen is one of many companies working on treatments with even greater potential in the treatment of the disease. Acumen is currently working on treatments with a ‘disease-modifying’ approach, designed to target the underlying causes of the condition. This is a field ripe with potential, as there are currently some 6 million Alzheimer’s patients in the US, 32 million globally.

Acumen has developed a drug candidate, sabirnetug (ACU193), and brought it into the clinical trial stage. The drug is a selective targeting agent working against toxic soluble amyloid beta oligomers, or AβOs. These are known to be an early trigger of Alzheimer’s and have been shown to be ‘persistent drivers’ of the neurodegeneration and other pathologies of the disease. Acumen’s sabirnetug helps to preserve neurologic function by preventing toxic AβOs from binding to dendritic spines.

Early clinical trials showed promise, and the company is now on track to initiate a Phase 2 clinical study during 1H24. The Phase 2 trial, ALTITUDE-AD, will study the efficacy of sabirnetug against early Alzheimer’s disease. A Phase 1 study, looking at a subcutaneous dosing option for sabirnetug, is also expected to start this year.

This biopharma company has caught the eye of analyst Geoff Meacham from Bank of America. Meacham sees Acumen’s drug candidate as a strong asset, but he also perceives the background conditions as favorable for the company.

“We continue to think ACU193 offers intriguing upside as a next—and possibly best-in-class—mAb by specifically targeting Aβ oligomers vs. its competitors. Indeed, while admittedly early, we thought the phase 1 data looked differentiated given its rapid onset of action on key biomarkers and limited safety issues. At the same time, Acumen should benefit from 1) a favorable regulatory backdrop; 2) infrastructure investments from its commercial rivals; and 3) improving clinical experiences (new guidelines, expanding diagnoses, enhanced treatment protocols/ risk mitigation, etc.). Thus, while we recognize the clinical and commercial risks, we continue to see strong upside potential,” Meacham opined.

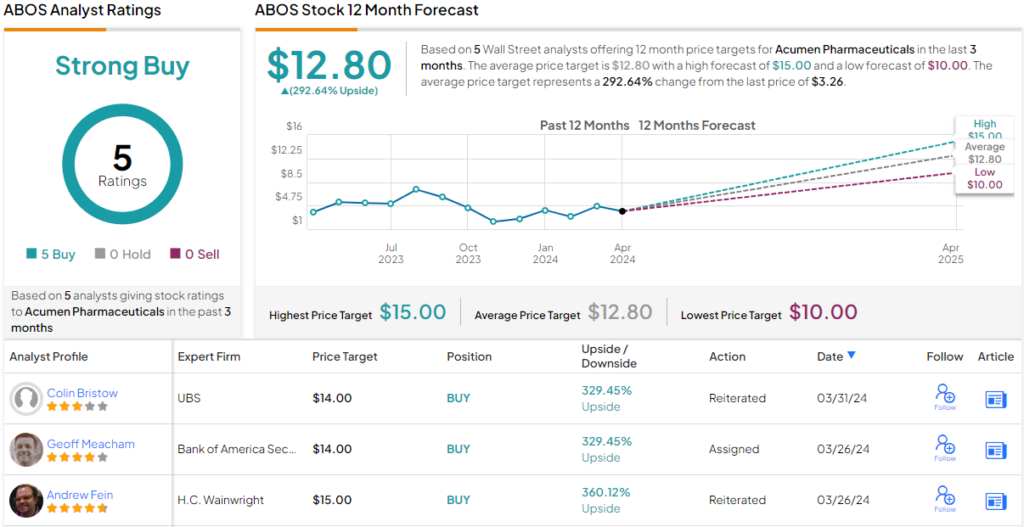

Building on these thoughts, Meacham proceeds to rate ABOS shares as a Buy, assigning the stock a $14 price target, which implies an upside of ~329% within a one-year horizon.

Overall, Acumen gets its Strong Buy consensus rating from 5 unanimously positive analyst reviews. The shares are trading for $3.27, and their $12.80 average price target suggests ~293% share appreciation for the coming 12 months.