- Aprile 17, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

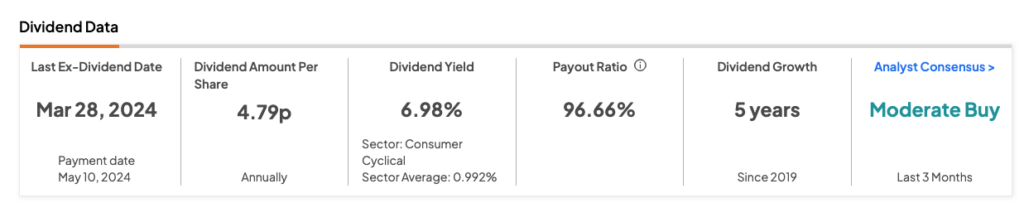

Among UK stocks, home-building company Taylor Wimpey PLC (GB:TW) offers an attractive dividend yield of 6.98%, which is way higher than the sector average of 0.99%. The company’s dividend policy is linked to the cyclical nature of its business. Nonetheless, TW is committed to maintaining regular dividends across all stages of the housing cycle, with additional returns distributed at opportune moments.

Let’s take a look at some details of Taylor Wimpey’s dividends.

Taylor Wimpey Dividends 2023

The company paid a total of £338 million to its shareholders as dividends in 2023. Even after this, the company maintained strong cash generation and ended the year with a net cash of £677.9 million.

Encouraging Outlook

Taylor Wimpey is showing some signs of improvement in trading in 2024. The company’s business inquiries have increased as reduced mortgage rates have had a favourable impact on affordability and confidence among its customer base. In 2024, the company’s net private sales rate from January to February 25, was 0.67 per outlet per week, compared to 0.62 during the same period in 2023.

Overall, the company is optimistic about the signs of recovery in the UK housing sector, offering relief to prospective buyers.

What is the Stock Price Forecast for Taylor Wimpey?

TW stock has received a Moderate Buy rating based on four Buy versus five Hold recommendations. The Taylor Wimpey share price target is 148.89p, implying 10.6% upside potential.