- Aprile 3, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The company’s remarkable performance can be attributed to the ever-growing demand for artificial intelligence (AI), which kept Nvidia’s GPUs (graphics processing units) in the spotlight.

Nvidia Stock: Q1 Recap

Nvidia maintained its dominant position through strategic investments in technologies such as AI, autonomous vehicles, and cloud computing. These moves helped bolster investor confidence in the company’s long-term growth prospects.

Another major driver of Nvidia’s stellar performance was the strong Q4 results released last month. The company reported substantial revenue growth, especially in its key business segments such as Gaming and Data Center (which provide cloud and AI services). Additionally, the company’s near-term guidance showed no signs of a slowdown. NVDA expects its first-quarter revenues to reach $24 billion, compared with $7.19 billion in the year-ago quarter.

During the quarter, Nvidia surpassed both Amazon (AMZN) and Alphabet (GOOGL) in terms of market capitalization. Further, it is close to exceeding Apple (AAPL) as well. Based on the April 2 closing price, NVDA’s market cap stood at $2.26 trillion, while AAPL stock sports a market cap of about $2.61 trillion.

Growth Prospects Remain Bright

Nvidia is well poised to expand its market share in the data center market with its continuous innovation in GPUs. Last month, the company launched its new AI processors, code-named Blackwell, which promise superior speed.

Furthermore, the AI craze and growing cloud-related product demand keep NVDA well-positioned for growth.

Is Nvidia a Buy, Sell, or Hold?

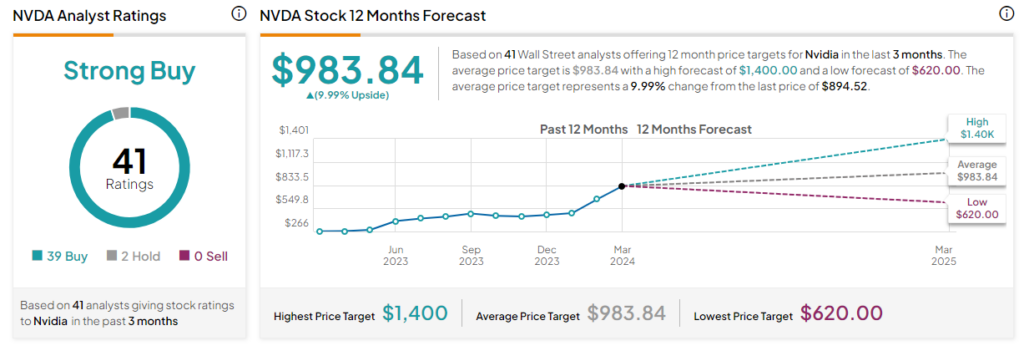

Overall, analysts remain optimistic about Nvidia. It has a Strong Buy consensus rating based on 39 Buy and two Hold recommendations. The analysts’ average price target on Nvidia stock of $983.84 implies 10% upside potential from current levels.