- Marzo 15, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Yet, it should also be noted that Rivian has regularly drawn compliments for the quality of its products. However, it is faced with one big problem it has yet to solve: it costs too much to make its cars, with the company realizing a big loss on each one sold. Meanwhile, it is burning through a lot of cash in order to fund operations.

The question is: are these just bumps in the road, or is Rivian in real trouble as competition in the EV world heats up?

Jefferies analyst Philippe Houchois thinks it’s probably just growing pains. But like EV pioneer Tesla, Rivian’s got a lot to prove to the skeptics.

“In our view,” said the 5-star analyst, “Rivian has looked closest to Tesla in ‘spirit’, with its own software stack, strong brand identity, global potential, and similar growth pains. An unmatched capital base could help correct gaps in the business model but the company is facing 2 critical if not existential tests this year: 1) deliver a $35-40k reduction in unit production costs from redesign, purchasing and manufacturing efficiency, & 2) demonstrate the R2 model can be developed at a significantly lower cost than R1, with R2 set to be formally presented on March 7th.”

These factors will dictate the conditions for Rivian to secure the approximately $2.5 billion funding required for the launch of the R2, and will also influence whether the company can maintain its independence or if its intellectual property assets might be considered more valuable to a bigger, more established entity.

As the year unfolds and Rivian goes through reduced volume in Q1 and Q2, Houchois sees volatility ahead for the shares and reckons that prior to turning FCF positive in 2027, the cash burn will reach $9 billion.

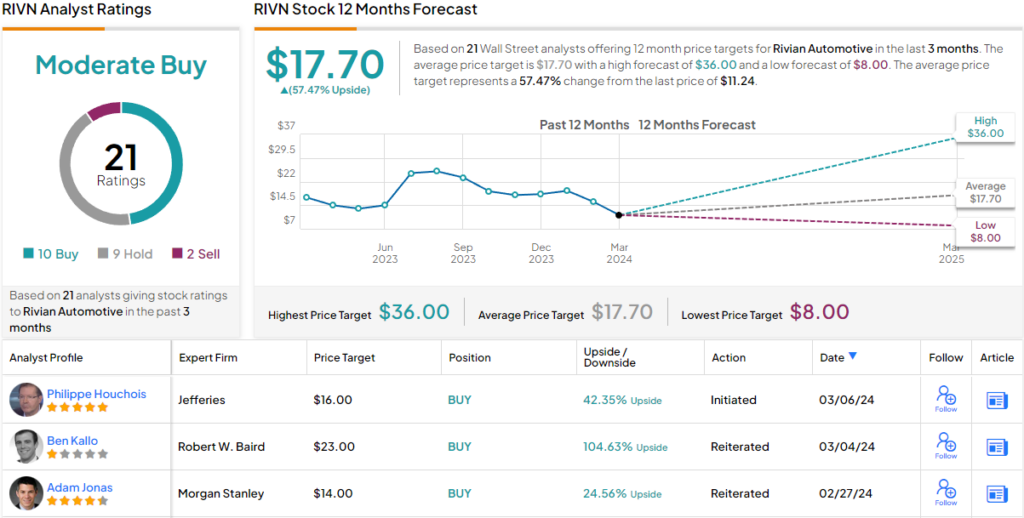

Nevertheless, with the share price hovering near all-time lows, Houchois senses an opportunity. As such, the analyst initiated coverage of Rivian with a Buy rating and $16 price target, suggesting shares will climb ~43% higher in the months ahead. What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 10 Buy ratings, 9 Holds (i.e. Neutral) and 2 Sells add up to a Moderate Buy consensus rating. In addition, the $17.70 average price target indicates ~57% upside potential.