- Marzo 8, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

“On one hand this is a modest disappointment as the view within Cupertino was that with roughly 2k employees on this initiative, an Apple Car was still on the medium term horizon,” Ives said. “On the other hand, the laser focus within Apple is ramping up and executing a broad AI strategy within the Apple ecosystem as it appears the vast majority of these engineers and developers will now focus their efforts on AI.”

The employees in Apple’s Special Products Group (SPG) working on Project Titan, will now move over to the artificial intelligence division, to turn their full attention to generative AI projects, a shift Ives says is “clearly the right move for Cook & Co. moving forward.” Ives also anticipates some layoffs as part of the project’s demise.

The AI opportunity, however, remains a big one. The recently released Vision Pro, Apple’s mixed-reality headset, represents Apple’s first serious foray into the AI game, and Ives anticipates generative AI will be introduced to the upcoming iPhone 16, in what will amount to the start of a “new frontier of growth” for the company. “We believe taking these Project Titan engineers and developers with all efforts on AI could further accelerate Apple’s AI initiatives over the next 12 to 18 months,” the top analyst summed up.

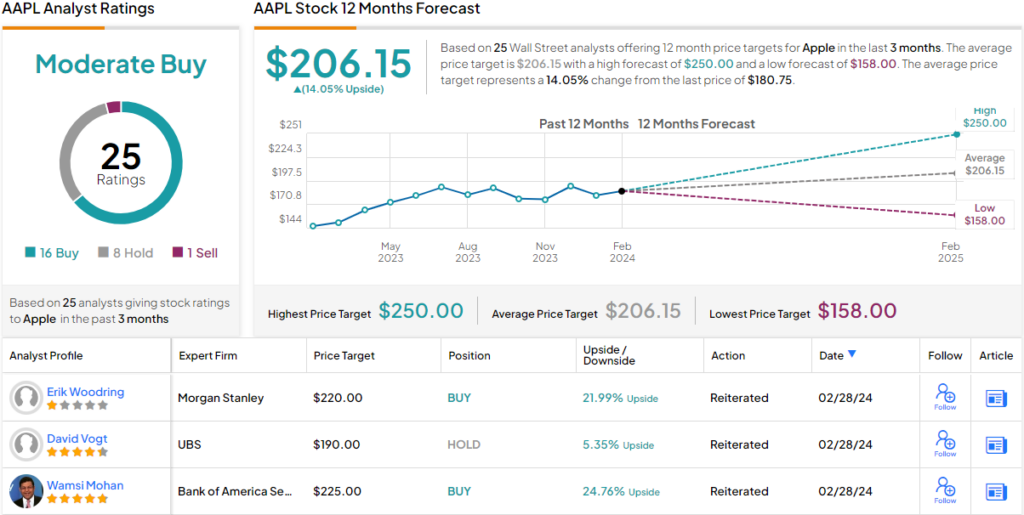

All told, Ives maintained an Outperform (i.e., Buy) rating on Apple shares to go along with a Street-high $250 price target, implying the stock will climb 38% higher in the year ahead.

Ives is the Street’s biggest AAPL bull amongst 16 positive reviews and with the addition of 8 Holds and 1 Sell, Apple stock claims a Moderate Buy consensus rating. The forecast calls for one-year returns of 13%, considering the average target clocks in at $206.15.