- Febbraio 13, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Nessun commento

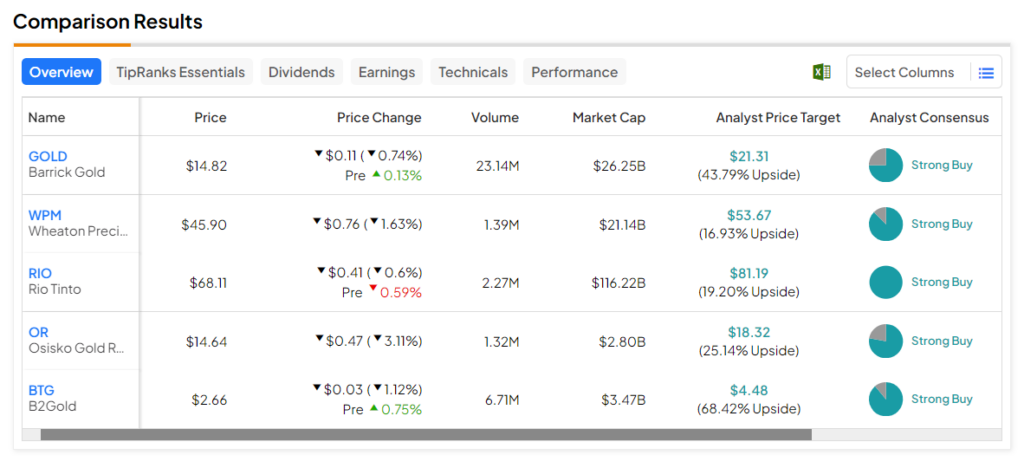

Here are five such stocks for investors to consider.

- Barrick Gold (NYSE:GOLD) – This gold mining company is engaged in the exploration, development, and production of gold and copper properties. GOLD stock’s average price target implies an upside potential of 43.79%.

- Wheaton Precious Metals (NYSE:WPM) – This company is engaged in the purchase of precious metals produced by mining companies. WPM stock’s price forecast of $53.67 implies 16.93% upside potential.

- Rio Tinto (NYSE:RIO) – Rio Tinto is a multinational mining corporation known for its operations in various commodities, including iron ore, aluminum, copper, and diamonds. The stock’s average price target implies an upside potential of 19.2%.

- Osisko Gold Royalties (NYSE:OR) – This royalty and streaming company is focused on precious metals, particularly gold. OR stock has an average price target of $18.32, which implies a 25.14% upside potential from current levels.

- B2Gold (NYSE:BTG) – B2Gold is a Canadian mining company primarily focused on gold exploration and production. BTG stock has an analyst consensus upside of 68.4%. Last week, two analysts rated the stock a Buy.