- Giugno 9, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

“If inflation stays sticky or it comes down because we enter a nontrivial recession – it’s equities that I think are in a scary place,” Asness recently opined. “They’re not priced very consistently with bonds.”

That’s not to say the co-founder and CIO of AQR Capital Management – a firm with $100 billion in assets under management – is turning away from stocks. In fact, the quant investing sage has been loading up on the equities he must believe are able to fend off any unwanted economic developments.

American International Group (AIG)

For our next Asness-endorsed name will turn to insurance giant AIG. The company is one of the world’s largest insurance and financial services organizations. Operating through various subsidiaries, AIG provides a wide range of insurance products and services to customers in over 80 countries. AIG’s offerings include property and casualty insurance, life insurance, retirement products, and mortgage insurance, among others.

Driven by robust underwriting gains, the global insurance powerhouse beat the profit estimates in its latest quarterly report – for 1Q23. Representing its strongest first quarter underwriting results, general insurance underwriting income climbed by 13% year-over-year to $502 million. That helped adj. EPS rise from $1.49 in the year-ago quarter to $1.63, while outpacing the $1.42 the analysts were looking for. And while partially negated by lower alternative investment income, total consolidated net investment income still climbed 9% to $3.5 billion.

Furthermore, the company gave a boost to its quarterly dividend, raising it from $0.32 to $0.36 per share, the first increase since 2016. The dividend currently yields 2.37%.

It’s safe to say Asness has confidence in AIG’s ongoing success. He increased his holdings by 79% in Q1 with the purchase of 2,557,149 shares. He now holds a total of 5,794,696 shares, worth ~$306 million.

AIG also gets the support of Goldman Sachs analyst Alex Scott. Scanning the latest financial statement, Scott explains why was impressed with the results. “We were very encouraged by the AIG earnings report this quarter as it showed favorable growth, further loss ratio improvement, favorable reserve development despite inflationary pressures, contained catastrophes despite elevated industry experience, net investment income benefiting to a greater degree than we expected from higher interest rates, and corporate expense discipline,” Scott said. “Further, we felt that the discussion around 1) the ultimate level of corporate expenses and 2) margin improvement in US personal lines was also a positive for the earnings power of the company.”

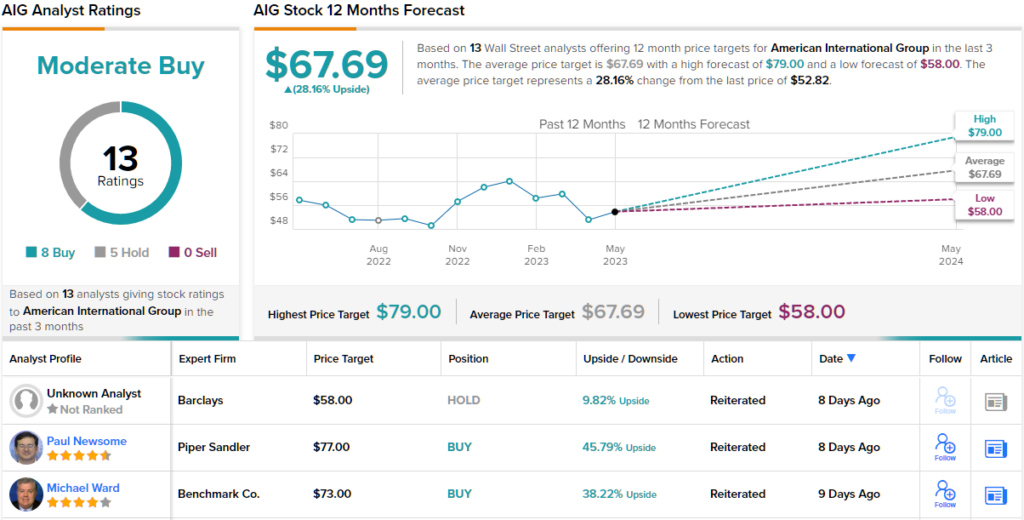

Accordingly, Scott rates AIG shares a Buy, backed by a $79 price target. The implication for investors? Potential upside of ~50% from current levels.

Overall, 13 analysts have chimed in with AIG reviews over the past 3 months, and these break down into 8 Buys and 5 Holds, adding up to a Moderate Buy consensus rating. Going by the $67.69 average target, a year from now, investors will be sitting on returns of 28%.