- Giugno 8, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The Cigna Group (CI)

If a recession is about to mess things up, a safe harbor is often provided by healthcare stocks, a segment seen as one able to withstand an economic downturn. Cigna might be a good example of their value. The global health services organization is a huge industry player, boasting a market cap over $72 billion, and specializing in providing a wide range of healthcare solutions to individuals, employers, and government entities.

The company operates via two primary divisions – Evernorth and Cigna Healthcare. Evernorth offers a comprehensive set of services and capabilities that include benefits management, care management, intelligence, and pharmacy solutions. Cigna Healthcare division brings together the former U.S. Medical segment (U.S. Commercial, U.S. Government) and the remaining International Health business. This division offers medical solutions across various markets with a focus on local needs.

The size and span of the business is easy to gauge from the company’s revenue haul. In the most recently reported quarter – for 1Q23 – the top-line reached $46.5 billion, amounting to a 5.7% year-over-year increase and beating the forecast by $1.07 billion. There was a beat on the bottom-line too, as adj. EPS of $5.41 came in above the $5.24 consensus estimate. For the outlook, the company raised expectations for both the sales and the profit profile.

Nevertheless, despite the market’s positive reaction to the print, with the shift in 2023 from value names to tech – and after outperforming last year – CI shares have taken a beating in 2023.

Evidently, Asness felt the time was right to increase his CI stake. During Q1, he loaded up on 560,014 shares, increasing his holdings by 95% to a total of 1,152,991 shares. These currently command a market value of over $316 million.

Mirroring that confident stance, Truist analyst David S. MacDonald saw plenty to like in the Q1 report. The 5-star analyst wrote, “We remain bullish on CI following a solid start to ’23 marked by balanced growth across segments, top and bottom-line beats, better MCR and raised guidance. Importantly, the call and enhanced 10-Q disclosures provided additional detail/comfort around rebate retention exposure/retail spread, PBM affordability and transparency and we think should help allay concerns about potential regulatory risk. Finally, the capital light business model continues to churn out attractive FCF, providing ample flexibility for ongoing investment/expansion.”

These comments underpin MacDonald’s Buy rating while his $375 price target makes room for 12-month returns of ~52%.

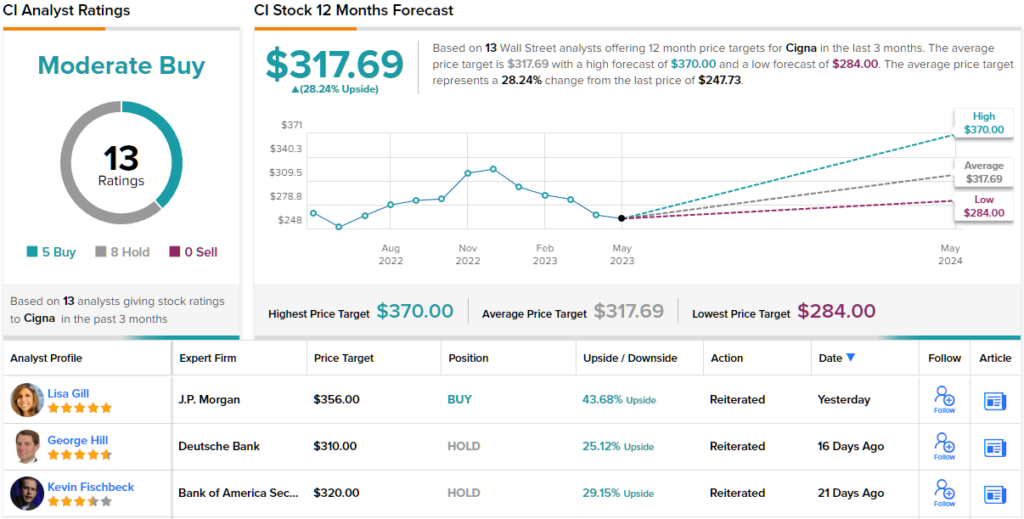

Elsewhere on the Street, the stock garners an additional 4 Buys and 8 Holds, for a Moderate Buy consensus rating. The average target stands at $317.69, suggesting ~28% from current levels. As an added bonus, CI also pays a dividend. The current quarterly payout stands at $1.23, yielding 1.88%.