- Maggio 29, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

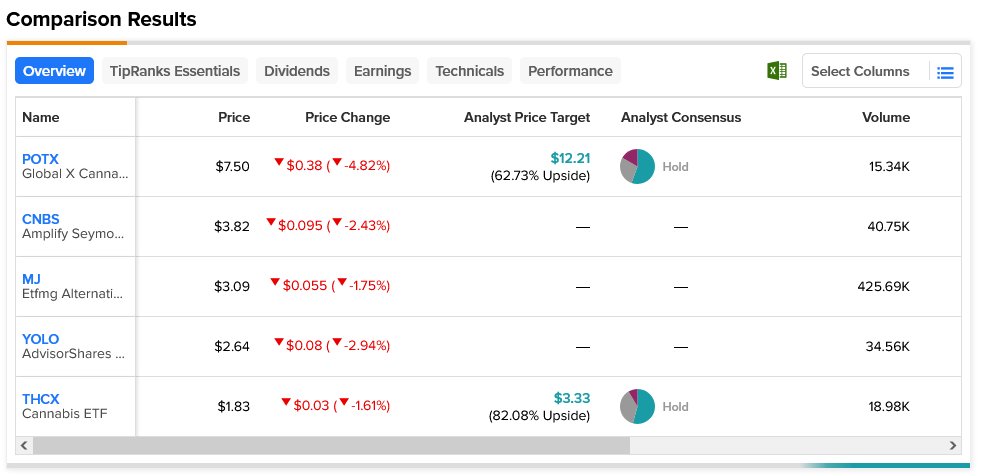

Indeed, the more Tilray some funds held, the worse off it was for them. For instance, Global X Cannabis (NASDAQ:POTX), which has 15.58% of its fund in Tilray, is down 28.9% this year and was down 4.82% at the time of writing. AdvisorShares Pure Cannabis (NYSEARCA:YOLO) has 4.84% allocated and was down 2.94%. Amplify Seymour Cannabis ETF (NYSEARCA:CNBS) has 10.26% allocated and was down 2.43% today. ETFMG Alternative Harvest ETF (NYSEARCA:MJ) has 8.08% allocated and was down 1.75% today. Finally, AYS Cannabis ETF (NYSEARCA:THCX) has 4.79% allocated and was down 1.61% in Friday’s trading.

So while the rate of descent didn’t coincide exactly with the amount of Tilray stock each fund held, the funds down hardest had substantial exposure to Tilray. AYS Cannabis was hit the lightest of the five and only has a Hold analyst consensus rating, but it also boasts 82.08% upside potential thanks to its average price target of $3.33. Meanwhile, Global X Cannabis is also a Hold but has 62.73% upside potential, thanks to its average price target of $12.21.