- Maggio 8, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

First under the Goldman Sachs microscope is ZTO Express, a delivery company that has taken advantage of the fast growing digital merchandising sector in China. Since its start in 2002, ZTO has expanded its market share in parcel delivery in China to more than 20%.

The company has grown with its home country’s e-commerce sector, and its growth, as a delivery company specializing in online orders, has in turn been an asset for online retailers. ZTO partners with some of China’s major online retail sites, including Alibaba and JD.com.

ZTO has powered its own expansion through its scalable network partner model. The partners typically handle first- and last-mile transport – the pickup and delivery end of the chain, while ZTO works at line-haul transport and sorting operations.

The model provides the company with both operational efficiency and economies of scale, while controlling costs. The company is working to expand its network, and has reported strong growth in parcel delivery volume in recent quarters.

As is typical for firms with tight connections to retail, ZTO shows a predictable seasonal pattern in its quarterly earnings and revenues. The high point is typically Q4, the height of many holiday shopping seasons, followed by a drop in Q1. The last quarter reported was Q4 2022, and the company will report its 1Q23 numbers next week, so a quick review of the previous quarter’s performance would be a good way to prepare.

In the final quarter of 2022, ZTO saw revenue of $1.43 billion, up 7.1% year-over-year. This result just missed the forecast, by slightly more than $20.4 million. The quarterly revenue was supported by strong growth in operations, including a 3.9% y/y increase in parcel volume, to 6.593 billion. ZTO boasted more than 31,000 outlets for pickup and delivery; 5,900 network partners; 98 sorting hubs; and some 11,000 self-owned line-haul truck as of December 31, 2022.

At the bottom line, ZTO reported a non-GAAP ‘earnings per American depositary share’ (EPS) of 37 cents, or 1 cent below expectations. The company’s adjusted EBITDA came in at $492.6 million, for a 24% year-over-year gain.

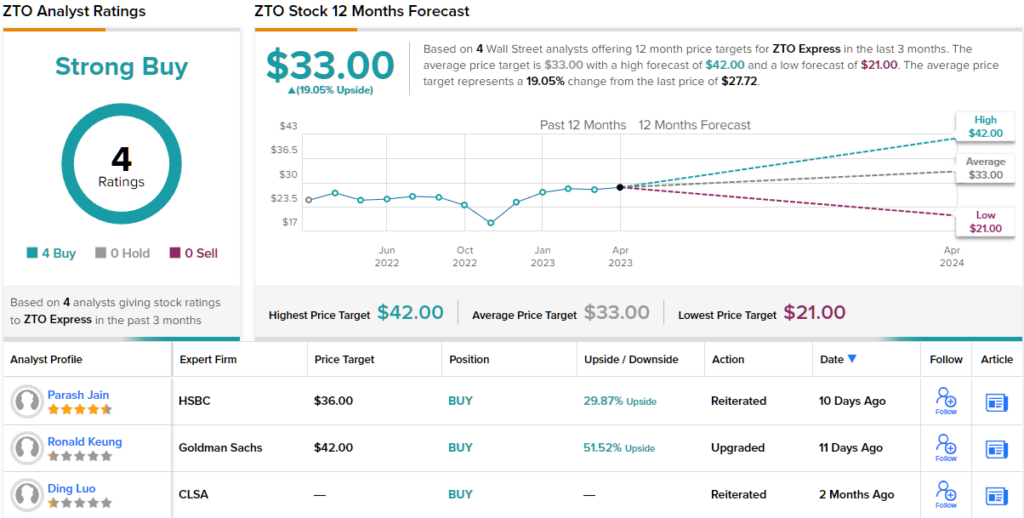

Goldman Sachs analyst Ronald Keung is upbeat about the rebound in China’s online economy, and writes of this stock, “We upgrade ZTO to Buy from Neutral, as (1) we expect its market share gain story to resume this year (we expect +1.5ppt share gain in FY23), (2) valuation looks attractive with 18X 23E ex-cash P/E coupled with 25% earnings growth CAGR, alongside (3) its dual-primary listing that management expects to complete this quarter, paving the way for its subsequent Southbound inclusion.”

To this end, Keung gives ZTO stock a price target of $42, implying a gain of 51.5% from current levels, to go along with his Buy rating.

Overall, all four of the recent analyst reviews on ZTO are positive, for a unanimous Strong Buy consensus rating. The shares are selling for $27.72, and the average price target of $33 suggests a potential increase of 19% going out to the one-year time horizon.