- Aprile 28, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Despite the excessive, overdone sell-off in Coinbase Global (NASDAQ:COIN) stock — or actually, because of it — this is likely a good time for Bitcoin (BTC-USD) believers to start a long position. I am bullish on COIN stock because extreme bearish sentiment from short-term traders offers a chance for contrarians to get in at a low price point.

Headquartered in Delaware, Coinbase Global operates a popular multi-cryptocurrency-trading platform known as Coinbase. Oftentimes, COIN stock follows the direction of the Bitcoin price, as that’s the most popular cryptocurrency. So, if you’re going to invest in Coinbase Global, you’ll definitely want to keep tabs on the latest developments with Bitcoin, the blockchain, and crypto in general.

Coinbase Global stock has been under pressure lately, and this is due in part to Bitcoin’s pullback from $30,000 to $27,000. Mainly, however, the anxiety surrounding Coinbase Global has been prompted by fears of a regulatory crypto crackdown in the U.S. What some folks should bear in mind, though, is that Coinbase Global is, as the company’s name suggests, a truly global enterprise.

Don’t Confuse Coinbase Global with FTX

If American regulators have cryptocurrency exchanges in their crosshairs in 2023, it’s primarily because of the fallout from the notorious crypto exchange FTX. Cool-headed investors, however, fully understand that Coinbase Global isn’t the same as FTX.

Under the questionable leadership of founder and CEO Samuel Bankman-Fried, FTX collapsed last year, with this unfortunate episode culminating in FTX filing for bankruptcy protection and Bankman-Fried resigning in disgrace. Consequently, it seems that some of FTX’s stakeholders might never recover their invested capital.

Since the FTX debacle, U.S.-based cryptocurrency exchanges have been under strong scrutiny from the Securities and Exchange Commission (SEC). As UBS (NYSE:UBS) Global Wealth Management Chief Investment Officer Mark Haefele explained, “It’s unsurprising to see more stringent U.S. regulatory action in the wake of the FTX collapse and related collateral pressure on high-profile crypto funds and platforms.”

Meanwhile, lawmakers in Europe just cleared regulations intended to govern major players in the cryptocurrency market. However, this could be viewed as bullish since regulations can bring a sense of order and legitimacy to the crypto market. Still, some traders remain reluctant to invest in Coinbase Global as the company is likely to face regulatory pressure in its home country.

Coinbase Global Looks Abroad for Opportunities

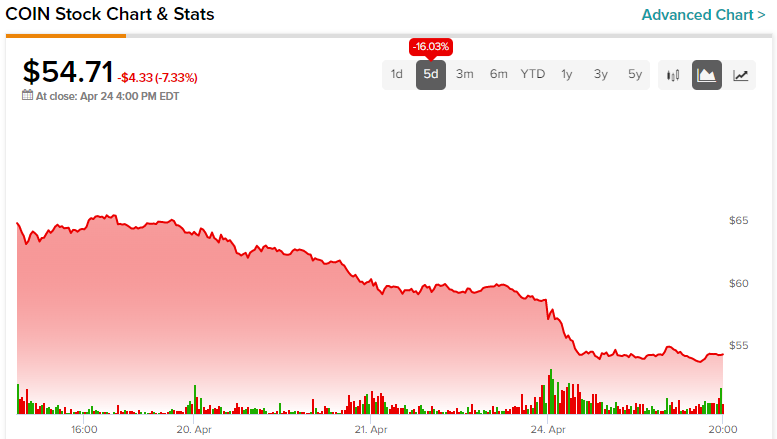

COIN stock fell by 7.4% today, though there was no company-specific news, and Bitcoin was just drifting sideways. I believe this is exactly the type of overextended drawdown that contrarian investors should look for. After all, Coinbase Global’s operations aren’t limited to the U.S., and the company’s overseas expansion plans could lead to top-line growth over the coming years.

Coinbase Global CEO Brian Armstrong made it crystal-clear that his company is prepared to move its primary operations outside of the U.S. “Anything is on the table, including relocating or whatever is necessary,” Armstrong declared recently.

If you’re worried that Armstrong will move Coinbase Global to a different country tomorrow or next week, relax. The CEO was only expressing his long-term vision for the company, based on how things pan out in the U.S. Armstrong stated, “I think in a number of years if we don’t see that regulatory clarity emerge in the U.S. we may have to consider investing more elsewhere in the world.”

Moreover, Armstrong and Coinbase Global aren’t all talk. The company took action not long ago when Coinbase Global obtained a license to operate in Bermuda. Additionally, the firm took steps to accelerate its presence in Brazil, Singapore, Canada, and the United Arab Emirates (UAE), while also maintaining a strong focus on the European cryptocurrency market.

Is COIN Stock a Buy, According to Analysts?

Turning to Wall Street, COIN stock is a Hold based on seven Buys, seven Holds, and five Sell ratings. The average Coinbase Global stock price target is $65.93, implying 20.5% upside potential.

Conclusion: Should You Consider COIN Stock?

Coinbase Global, like all cryptocurrency exchanges, will have to deal with regulatory scrutiny in the 2020s. This doesn’t mean Coinbase Global stock should be sold in a state of panic, though. If you’re bullish on Bitcoin for the long term, then you should be very interested in Coinbase Global. The recent sell-off in COIN stock appears to be based on fears of a worst-case scenario in the U.S.

However, if worse comes to worst, the company can set its sights on new markets with rapid growth potential. Therefore, right now is a great time to consider Coinbase Global stock, especially while the share price is still down.