- Dicembre 10, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

We’ll start in the oil and gas industry, where EOG Resources is one of North America’s largest hydrocarbon exploration and production firm. EOG boasts an $82 billion market cap and operations in rich oil and gas production fields, such as Eagle Ford in Texas, Anadarko in Oklahoma, and the Williston Basin of North Dakota-Montana, among others. Offshore, EOG has operations near the Caribbean island of Trinidad.

For EOG, this is big business. The company reported $7.6 billion at the top line for 3Q22, a total that was up an impressive 58% year-over-year. The company’s adjusted net income rose to $2.2 billion, up 69% y/y, and adjusted EPS, at $3.71, was up 71% from the year-ago quarter. Free cash flow was reported at $2.3 billion. These numbers reflected a combination of increasing demand in 2022 post-pandemic, high prices for oil and natural gas, and increased production.

On the dividend front, EOG declared both a regular payment and a special payment in Q3. The regular common stock dividend was set at 82.5 cents per share, or $3.30 annualized, and yields 2.3%, about average. The supplement, however, was $1.50 per common share, and made the total dividend payment $.2.32; at that rate, the annualized payment of $9.30 yields 6.6%, more than triple the market’s average dividend payment.

This hydrocarbon firm was clearly attractive to Steve Cohen, who bought 1,174,838 shares in Q3. This is a new position for his firm, and a substantial one. At current share prices, this holding is worth over $165 million.

Cohen is not the only bull running for EOG. BMO analyst Phillip Jungwirth notes this company’s solid divided – and especially the increased special payment, noting: “The special dividend exceeded our expectation, and EOG is well positioned to continue to exceed its +60% FCF capital return framework given its net cash position.”

Jungwirth goes on to discusses EOG’s path forward, saying, “While the shale industry has faced challenges this year, EOG has consistently delivered differentiated performance owing to its multi-basin, core acreage footprint, innovative culture, operational expertise, and advantaged marketing position. Exploration success has further extended the company’s runway of double premium inventory, with the recently announced Ohio Utica play, along with Dorado, poised to support overall production growth and returns in future years.”

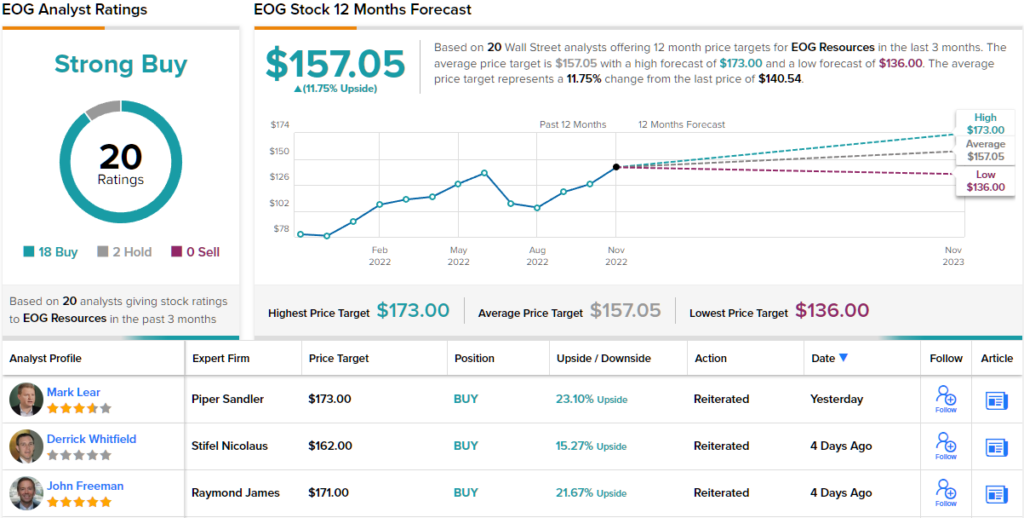

Following from his upbeat stance on this major oil and gas company, Jungwirth rats EOG shares an Outperform (i.e. Buy), and sets a price target of $160 to imply a one-year potential gain of 14%. Based on the current dividend yield and the expected price appreciation, the stock has ~20% potential total return profile. bon explorers don’t have to go begging for Wall Street’s analysts to check them out – and EOG has 20 analyst reviews on record. These include 18 Buys against just 2 Holds, for a Strong Buy consensus rating on the stock.