- Giugno 24, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Based out of Oklahoma City, Devon Energy is primarily focused on hydrocarbon exploration in the United States. As of December 31, 2021, the company had reserves of 1,625 million barrels of oil equivalent. This comprised of 44% petroleum, 27% natural gas liquids, and 29% natural gas.

Notably, the company has a market cap of $38.29 billion.

In its latest results for the first quarter, the company reported revenues of $3.81 billion, up 85.9% year-over-year. Moreover, the company reported an adjusted EPS of $1.88 which denotes a year-over-year growth of 35%.

Further, total production stood at 575,000 Barrel of Oil Equivalent (BOE) per day, up 15.2% year-over-year.

Moreover, the company also recently announced the acquisition of RimRock Oil & Gas’ leasehold interest and related assets in the Williston Basin for $865 million.

Following the announcement of the acquisition, Freeman reiterated a Buy rating on the stock. The analyst, however, raised his price target from $90 to $105, which implies upside potential of 75.9% from current levels.

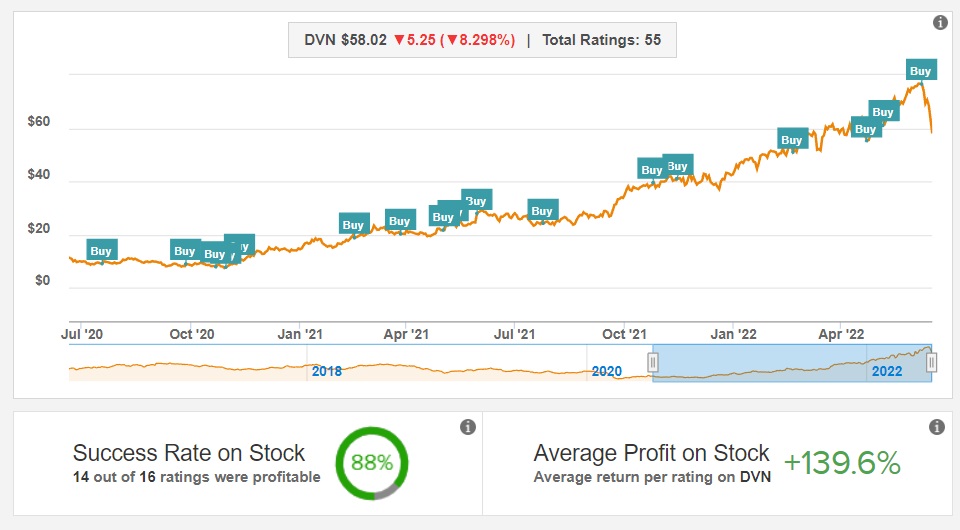

With a success rate of 88%, the analyst has rated the stock a total of 55 times. Further, he has generated an average profit of 139.6% on the stock.

Overall, consensus among analysts is a Moderate Buy based on 11 Buys and six Holds. The average DVN price target of $83.59 implies upside potential of 44.1% from current levels. Shares have gained 31.6% over the past year.