- Giugno 23, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

As a cruise ship operator in a very discretionary market sector, arguably most investors want nothing to do with Carnival Corp (CCJ). However, when drilling into the nuanced dynamics surrounding CCL stock, it could surprise onlookers. As near-term speculation, I am bullish on CCL.

Just from personal observation, it doesn’t take much to understand that something is desperately wrong with the current economic framework. From the pain at the pump to sticker shock in the grocery aisle, the American consumer is facing financial stresses to degrees not felt for decades. Beyond this point, households have also suffered supply shortages, most recently affecting feminine hygiene products.

As if embattled workers needed official confirmation of the troubles, Bloomberg reported several days ago that the University of Michigan’s index of consumer sentiment slipped to 50.2 points in June using preliminary data, down conspicuously from 58.4 points in May. Essentially, the pessimism plunged the barometer to the lowest level on record.

Of course, the main culprit is the blistering inflation rate. Following the initial intrusion of the COVID-19 pandemic and the subsequent influx of nearly $5 trillion of government stimulus – of which $1.8 trillion was earmarked for individuals and families – the money supply logically had nowhere to go but up. Though the stimulus arguably saved the U.S. economy, it did not do so without cost.

Today, the American public is paying the piper, increasingly bearing the weight of monetary negligence. Under this circumstance, it makes little sense for companies like Carnival to swing higher. Yet on the June 17 session, CCL stock did just that, soaring nearly 10% for the day.

What’s going on?

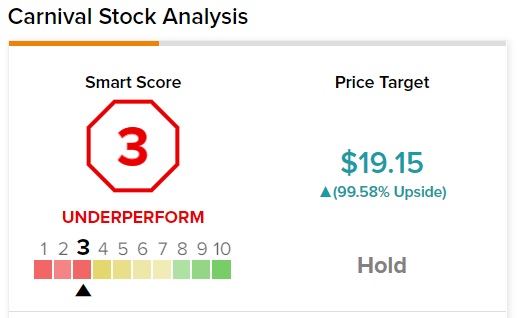

On TipRanks, CCL scores a 3 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to underperform the broader market.

The Psychology of ‘Revenge Travel’

In a world suddenly depicted through memes, one concoction of the new normal stood out: revenge travel. Similar to the retail revenge phenomenon, revenge travel is the colloquial description for pent-up demand. For about two years, consumers suffered through lockdowns, social distancing protocols and certain restrictions on commerce. People being people, they want to feel human again. Part of that involves going out on vacations.

Indeed, one of the nuanced takeaways from the poor earnings performances of big-box retailers Walmart (WMT) and Target (TGT) is that a significant portion of the disappointments could be traced to behavioral shifts. No longer was the consumer satisfied with acquiring physical goods. Instead, with travel restrictions gradually being lifted, people desired social events that were earlier denied to them.

Enter what many travel experts have cited as increased demand for experiences. Basically, consumers want to make new memories as the mere acquisition of stuff could not satiate the broader restlessness.

To be clear, mounting evidence suggests that rising inflation is affecting consumers travel plans, with many choosing to vacation closer to home to save money. But the evidence also shows that people are unwilling to be grounded.

According to a July 2020 UC Davis Health report, COVID fatigue – or the mental and psychological pressures associated with dealing with the pandemic – was taking its toll on the population. If that was the case two years ago, the revenge travel phenomenon is even more powerful today, thus bolstering the case for CCL stock.

Inflation as the Unintuitive Tailwind

Still, as fears of a global recession mount, the idea of taking a Carnival cruise seems reckless on many levels. Fundamentally, people need to be saving money ahead of a possible economic downturn, not spending it.

At the same time, traders are placing curiously bullish wagers on CCL stock. For instance, after the close of the June 17 session, Carnival was the recipient of unusual activity in the options market. For instance, $12.50 calls with an expiration date of Aug. 19, 2022 saw volume of 906 contracts against an open interest reading of 17.

On the same expiration date, $10 and $17.50 call options also picked up unusually optimistic bets. Fundamentally, inflation itself could be the surprising catalyst for Carnival stock.

As established earlier, Americans have been suffering from collective cabin fever for roughly two years. Now that circumstances have normalized considerably, the opportunity to travel is too big a temptation for many folks. As well, the rapidly eroding purchasing power of the dollar incentivizes vacationers to book now instead of later.

It really comes down to the pernicious nature of inflation. Rather than sparking a savings mentality, it’s more rational to spend on goods and services people would have bought anyways, since costs would likely rise over time. Thus, while it’s initially unintuitive, Carnival is likely to pick up demand from people thinking ahead of the curve.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, CCL is a Hold, based on two Buy, six Hold and four Sell ratings. The average Carnival price target is $19.15, implying 99.58% upside potential.

Don’t go Overboard

To be sure, investors will want to avoid over exuberance with CCL stock. While travel demand may expand in the near term, the longer-term picture is cloudy. At some point, cash outlays such as core living expenses could become so onerous that even the most restless consumer must cancel their vacation plans altogether.

Still, as a speculative trade for the next few months, CCL stock might make sense for certain market participants. Essentially, the psychological strain for social experiences has created a unique air pocket in the otherwise embattled consumer economy.