- Giugno 4, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

From e-commerce we’ll move over to space flight. While Elon Musk’s SpaceX has hogged the headlines in the private venture space industry, it’s far from the only game in town. Rocket Lab is a space-launch company with a reusable small launch vehicle, the Electron, capable of inserting 300kg payloads into low Earth orbit. The Electron rocket is the only reusable small launch vehicle currently in service, and is in high demand – Rocket Labs has made 26 successful launches since introducing it, and deployed 146 satellites.

Rocket Lab is working to expand the launch options available to customers with the development of the Neutron launch vehicle. The Neutron, when complete, will operate in the 8-ton payload class, and will be able to launch cargos capable of leaving Earth orbit altogether. The US Space Force last year awarded Rocket Lab a $24 million contract for development work on the upper stage of the Neutron vehicle.

In addition to its launch vehicle, Rocket Lab offers customers access to the Photon spacecraft, a small-size configurable vehicle launched as the upper stage of an Electron rocket. The Photon can be optimized for low- and mid-altitude Earth orbits, geosynchronous orbits, or even extra-Earth flights to the Moon or the nearby planets Mars and Venus. There are currently 2 Photon spacecraft orbiting Earth. In late May, Rocket Lab announced that its customer Varda Space Industries, which had previously ordered 3 Photon spacecraft, had increased its order to 4.

Also in May, Rocket Lab announced that the CAPSTONE spacecraft, a joint operation undertaken on contract with NASA, had been delivered to its New Zealand launch facility. Rocket Lab will now begin integrating CAPSTONE with the launch vehicle, as part of a long-duration NASA mission to the Moon.

This space launch company has proved of interest to Fisher, who recently bought up 538,913 shares of RKLB. His stake in the company is worth $2.62 million at current share prices.

Rocket Lab has also caught the attention of Deutsche Bank analyst Edison Yu, who writes: “In our view, the company’s growth and margins across various business lines are set to inflect over the next year and its new larger Neutron rocket will be fully sold out for at least 2-3 years even before its maiden voyage. Moreover, we think its Space Systems segment remains unappreciated despite winning the landmark Globalstar/MDA contract which surprised many legacy competitors.”

“Looking ahead, the stock may be volatile due to tactical factors (growth sell-off, shift in shareholder base, etc…) but we think the enormous disconnect in valuation will likely compress relative to SpaceX which in the private market was reportedly seeking a $127bn valuation just a few days ago (RKLB now trading at only ~$2bn),” the analyst added.

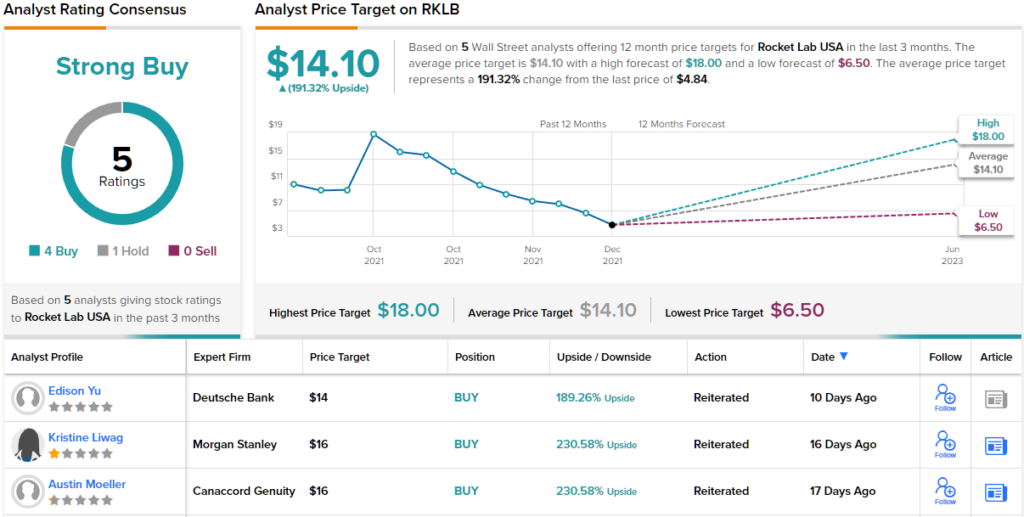

Yu brings a Buy rating for the stock along with his comments, and his price target here, at $14 per share, suggests ~189% upside for the year ahead.

His Wall Street peers are also upbeat on the prospects for Rocket Lab, as shown by the 4 to 1 breakdown in analyst reviews, favoring Buys over Holds and supporting a Strong Buy consensus view. The shares are selling for $4.86 and the $14.10 average price target implies a high 191% upside this year.

- Giugno 4, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting