- Giugno 1, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Shares of iconic agriculture equipment maker Deere (DE) plunged violently (more than 14%) following the release of some mixed second-quarter earnings results that saw revenues rise 11% year over year to $13.37 billion. Undoubtedly, there was a bit of margin pressure that likely induced such a reaction.

In the following trading sessions, Deere stock eventually regained most of the ground lost as investors had a chance to digest the quarter. Though numerous headwinds weighed down the quarter, management has continued to do a pretty good job of managing costs.

Thus far, demand for Deere equipment has been quite robust coming out of the pandemic. Still, there’s fear that we could be headed for a recession over the next year. Such an economic downturn could weigh heavily on heavy-duty equipment demand and act as an overhang on those turbulent shares of Deere.

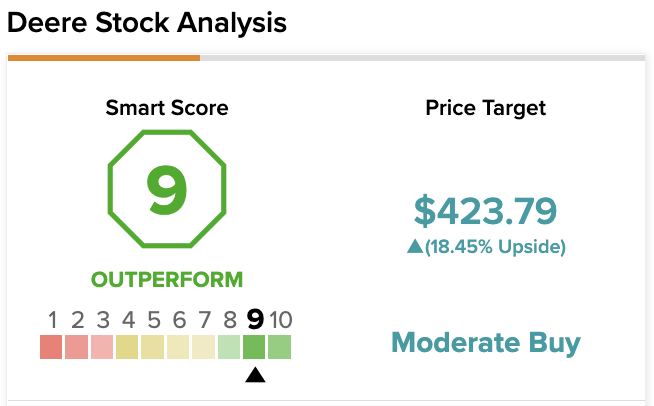

On TipRanks, DE scores a 9 out of 10 on the Smart Score spectrum. This indicates a high potential for the stock to outperform the broader market.

Macro Risks Could Weigh on Deere Stock in the Second Half

Indeed, Russia’s invasion of Ukraine has only intensified and accelerated global inflation. With higher fertilizer prices and other costs, the budget of farmers has been feeling a bit of pressure. Indeed, with a recession thrown in, demand for new Deere equipment could be pushed out further, making a sustained rally in the stock difficult. Additionally, the forestry and construction equipment business may also be at risk of weakness as firms brace for a downturn.

In any case, Deere stock already looks modestly priced at current levels. If anything, it’s a compelling value play despite its higher degree of economic sensitivity. At writing, the stock trades at 18.7 times trailing earnings and just 2.4 times sales.

Assuming the Federal Reserve can steer clear of a hard-landing amid its rate-hike cycle, Deere stock looks too cheap to ignore. However, if a recession proves severe, the downside risks for such a big-ticket discretionary could be excessive.

Given recession risks, many may insist on a wider margin of safety with the name. With so much in the way of uncertainty, I am neutral on DE stock.

For now, the agriculture market looks incredibly robust. While I do not doubt management’s ability to overcome recent supply-side constraints, I’m not sure that demand will remain strong if the Fed pulls the brakes on economic growth. Undoubtedly, demand for big-ticket equipment can go from booming to busting very quickly. With the effect of inflation factored in, there’s also a chance that margins could erode further going into year’s end.

Undoubtedly, Deere is a premium brand in the heavy-duty farming equipment space. With that comes a degree of pricing power. However, the company may not be able to pass on all of the costs to the consumer without taking a near-term hit to sales. Arguably, a margin hit may be better to stomach than a sales hit in the face of a potential recession. In any case, management should be able to find the right balance amid inflationary pressures.

Long-term Fundamentals Remain Sound for Deere

Though management remains quite upbeat, the medium-term outlook could be cloudly for Deere and other discretionary firms. With some degree of recession risk already baked into the stock price, today’s entry point at around $358 per share may prove attractive from a longer-term perspective.

The company is doing a lot of things right, specifically with the modernization (and electrification) of its equipment, which could fuel robust demand over the course of the next decade. Undoubtedly, being on the right side of a secular trend is always a good thing. However, it’s unclear as to how the firm will cope if we are due for a period of stagflation.

During the 2008-09 market crash, Deere stock lost over 70% of its value, and it took many years to sustain a rally to much higher levels. Indeed, the severity of the next recession is unlikely to be as bad as 2008-09. However, Deere stock’s performance through difficult times is noteworthy.

In any case, strong management and secular tailwinds should help the firm offset a portion of the nearer-term headwinds. At the end of the day, Deere is a quality blue chip with many long-term catalysts that should not be ignored by long-term thinkers.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, DE stock comes in as a Moderate Buy. Out of 15 analyst ratings, there are 10 Buy recommendations and five Hold recommendations.

The average Deere price target is $423.79, implying an upside of 18.45%. Analyst price targets range from a low of $370 per share to a high of $472 per share.

The Bottom Line on Deere Stock

DE isn’t at all expensive as it fluctuates around the low end of its year-long consolidation channel in the $350-400 range. As a more cyclical play, potential recessionary or stagflationary headwinds could keep the stock from breaking out. In any case, Wall Street analysts remain bullish on the name, as demand hasn’t yet pointed to an economic downturn.