- Maggio 3, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

On Wednesday, PayPal (PYPL) released 1Q22 earnings, in which the company lowered its outlook for the year. While such behavior in recent times would result in a backlash from Wall Street, this time the market gods were more forgiving.

Shares actually pushed higher in the subsequent session, as some Wall Street analysts had sensed prior forecasts were too optimistic. One of these is Jefferies analyst Trevor Williams, who thinks the “much-needed cut to FY22 should help put a floor under the stock.” Indeed, the bottom has been falling out at an alarming rate; PayPal shares are still down 52% year-to-date.

The digital payments giant is now anticipating revenue growth between 11% to 13% this year, compared to the prior expectation of 15% to 17% revenue growth.

The adjusted EPS forecast was also lowered – from between $4.60 to $4.75 to the range between $3.81 and $3.93. Lastly, while the company previously said it is targeting 15 million to 20 million net new active accounts (NNAs) in 2022, it is now aiming to add around 10 million.

Williams says the lowered top-line outlook factors in the “continued normalization in consumer behavior.” These changes include a return to brick/mortar, inflation impacting discretionary demand among low-income customers, and more being spent on services rather than goods.

“Additionally,” says Williams, “the new range assumes a modest amount of incremental macro pressure for the balance of FY22–a prudent (rather than conservative, in our view) stance, as we expect a continuation of the trends that have pressured results in recent quarters.”

As for the bottom-line revisions, higher transaction expenses are pressurizing margins amidst a “recovery” in credit volumes.

PayPal is hoping to counter the anticipated slowdown in NNAs with a boost to ARPU (average revenue per user) growth, but this is a strategy that has yet to prove itself and for any re-rating to take place, Williams is still waiting for “greater visibility into ’23+.”

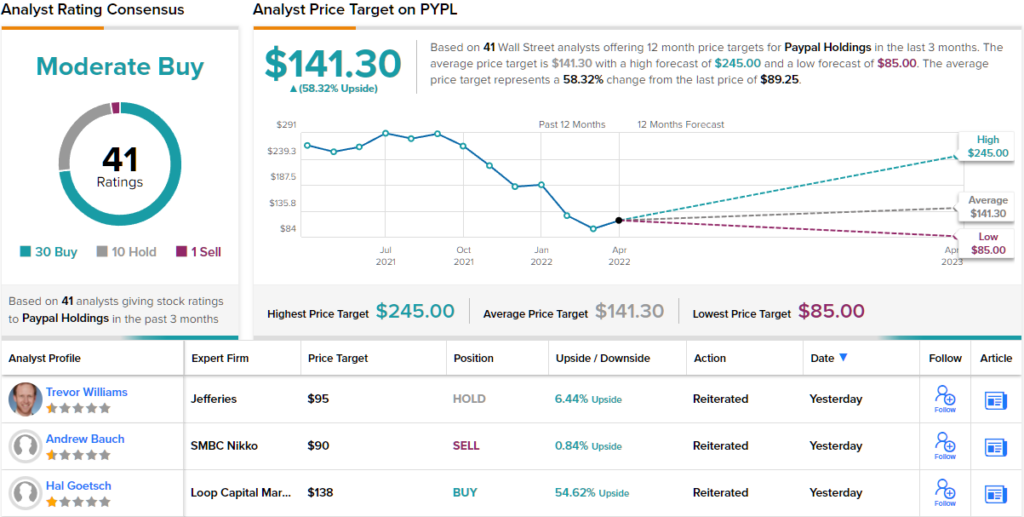

Therefore, Williams rates PYPL a Hold along with a $95 price target, suggesting shares will stay range bound for the foreseeable future.

Overall, there are currently 40 analyst reviews on file for PYPL, of which 30 are to Buy, 10 say Hold and one implores to Sell, all coalescing to a Moderate Buy consensus rating. However, all agree the shares are now undervalued; going by the $141.30 average target, the stock will be changing hands for a 58% premium a year from now.