- Aprile 19, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

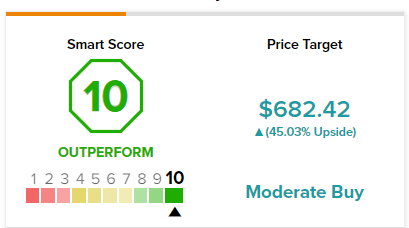

California-based Lam Research has received a “Perfect 10” Smart Score rating on TipRanks. It manufactures, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits globally. The company offers thin film deposition, plasma etch, photoresist strip, and wafer cleaning.

With a market capitalization of $65.64 billion and recording losses of 34.93% year-to-date, LRCX stock is trading toward its 52-week low price. But supported by its strong fundamentals and financial stability, the company fits in to buy the dips strategy for investors.

In the current era of digitization, the rising global demand for semiconductor chips and microcontrollers promises steady growth for semiconductor manufacturing equipment makers. With huge investments underway to boost chip production by renowned semiconductor manufacturers, Lam Research’s client base, which includes Micron Technology, Inc. (MU), Taiwan Semiconductor Manufacturing Company Limited (TSM), and Samsung, are likely to remain decent contributors to total revenue of the firm in the long run.

After reporting better-than-expected earnings in the December quarter, Lam Research is expected to report earnings of $7.48 per share on revenues of $4.26 billion for the March quarter, to be reported tomorrow after the market close. The company provided a revenue guidance range of $3.95 billion to $4.55 billion, while adjusted earnings are expected in the range of $6.70 to $8.20 per share.

In addition, Lam Research has a long track record of paying dividends, with consecutive increases. The dividend amount has grown from $0.18 per share in 2014 to the current rate of $1.50 per share. The stock offers investors a dividend yield of 1.27%, which compares favorably with the sector average of 0.729%.

Recently, Morgan Stanley analyst Joseph Moore reiterated a Buy rating and a price target of $730 (55.14% upside potential) on Lam Research.

Though Moore has reduced estimates due to ongoing supply challenges, he maintains a bullish stance on long-term expectations. Nevertheless, the analyst believes that despite strong demand, minor supply chain issues might impact revenues in upcoming quarters.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys and six Holds. The average Lam Research price target of $682.42 implies 45.03% upside potential.

In addition, bloggers seem enthused by the company’s prospects. TipRanks data shows that financial blogger opinions are 91% Bullish on LRCX, compared to a sector average of 68%.