- Aprile 19, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

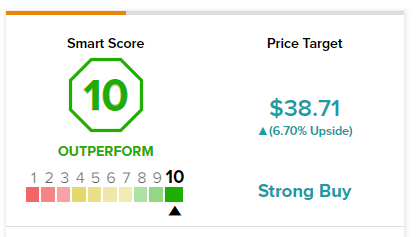

Independent oil and natural gas company Antero Resources received a “Perfect 10” Smart Score rating on TipRanks. The firm is engaged in the exploration, development, and production of natural gas, NGLs, and oil.

With a market capitalization of $11.42 billion, AR stock is trading near 52-week highs and exploded 302.22% over the past year and 104.62% year-to-date.

With sky-high commodity prices due to Russia’s violent invasion of Ukraine, Antero is well-positioned to capitalize on the opportunity. Additionally, the debt reduction strategy of the company and target to return capital to shareholders, along with expected improvement in production has tempted investors to add this stock to their portfolio for long-term gains.

In the last earnings release, Michael Kennedy, CFO of Antero said, “The dramatic reduction in our absolute debt, below $2.0 billion in the first quarter of 2022, enables us to initiate a return of capital program. Going forward we will target returning 25% to 50% of Free Cash Flow annually to our shareholders, beginning with the $1.0 billion share repurchase program that is effective immediately.”

In the soon-to-be-reported quarter, Wall Street expects earnings of $1.15 per share on revenues of $1.46 billion. This indicates more than double earnings expected sequentially from $0.46 per share recorded in the fourth quarter of 2021.

Ahead of the first-quarter earnings release, Wells Fargo analyst Nitin Kumar maintained a Buy rating on the stock and raised his price target to $38 from $36. Kumar’s price target implies 4.74% upside potential over the next 12 months.

Kumar expects Antero to put light on its participation in the global LNG trade, revised its free cash flow outlook for 2022 and 2023, and update on the share repurchase program, during its first-quarter earnings call. The analyst is positive about the free cash flow outlook, which he expects to be driven by a rally in commodity prices.

Also, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Antero, with 26.5% of investors maintaining portfolios on TipRanks increasing their exposure to AR stock over the past 30 days. Furthermore, 3.6% of these individuals have raised their holdings in the recent week.

Overall, consensus among analysts is a Strong Buy based on six Buys versus one Hold. The average Antero price target of $38.71 implies 6.7% upside potential from current levels.