- Aprile 8, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Founded in 1984, Papa John’s operates on a similar business model to Domino’s, with operations both in the U.S. and abroad. Papa John’s focus on always using fresh ingredients instead of frozen has propelled consumers’ favor towards the pizzeria’s offerings.

PZZA stock has lost 19.6% year-to-date amid the broader market sell-off compared to a 18.3% gain over the past year.

Papa John’s also pays regular quarterly dividends to the tune of $0.35 per share to shareholders with a current dividend yield of 1.19%. The company also has approximately $411.5 million remaining under its current share repurchase program as of February 17, 2022.

In its Q4 and full-year fiscal 2021 results ending December 26, 2021, Papa John’s beat both revenue and earnings estimates despite supply chain, labor, and Omicron-related challenges. Moreover, the company even reported a solid jump in both its comparable sales growth and global system-wide restaurant sales growth figures.

Notably, Papa John’s ended the fiscal with 5,650 stores worldwide, with 250-unit additions in the year. The story doesn’t end here! Post its earnings, PZZA has announced a historic strategic deal with FountainVest Partners to open over 1,350 new stores in South China by 2040, which is one of the world’s fastest-growing pizza delivery markets.

Similarly, on March 31, Papa John’s also announced a major strategic refranchising agreement with long-term partner Sun Holdings to accelerate domestic development. The latter is also committed to opening 100 new stores across high-growth markets, including Texas, by 2029.

Earlier in March, analyst O`Cull revisited the impact of rising wheat prices on Papa John’s performance due to the ongoing war. The analyst noted that PZZA uses hard red spring (HRS) wheat in its pizza dough, which is mostly sourced domestically as opposted to the winter varietals produced in Russia.

Nevertheless, the analyst stated, “Prices remained elevated YoY in early 2022, however, the recent conflict has exacerbated the rise in wheat prices. In the short term, we do not believe the company has significant exposure to rising wheat prices given its forward buying strategy; however, if recent market prices persist, we estimate it could pressure restaurant margin by roughly 50 bps 2H22.”

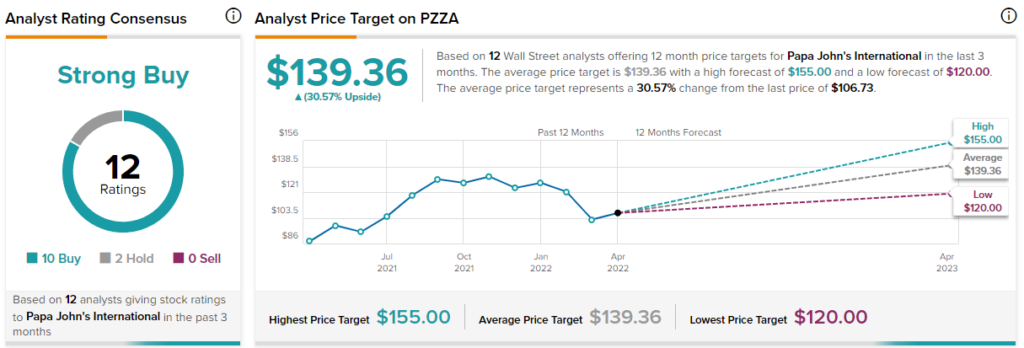

Analyst O`Cull has the most conviction towards PZZA under his restaurant coverage. He has a Buy rating on the stock with a price target of $155, which implies 45.2% upside potential from current levels.

The other analysts on the Street are highly optimistic about the stock, with a Strong Buy consensus rating based on 10 Buys and two Holds. The average Papa John’s price target of $139.36 implies 30.6% upside potential to current levels.