- Aprile 7, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Founded in 1960, the Domino’s Pizza brand is one of the hot favorites of pizza lovers with its array of everyday value meals and combo deals suiting each individual’s appetite. The pizzeria operates through a mix of company-owned and franchise models both in the U.S. and international markets.

The DPZ stock has lost over 29% year-to-date and gained 3.6% over the past year. The company even pays a regular quarterly dividend of $1.10 per share, reflecting a current yield of 0.99%. To date, the company has approximately $700 million in share repurchases remaining under the current program.

In its recent results for Q4 and the year ending January 2, 2022, Domino’s missed expectations on both revenue and earnings. However, the company did manage to report moderate growth in same-store sales for both Q4 and FY21. At the end of the quarter, Domino’s had a total of 18,848 stores across the globe.

As a tradition, Domino’s provides an outlook for the next two to three years’ time frame, and likewise, the company has projected a Global retail sales growth between 6% and 10% and Global net unit growth of between 6% and 8%. Historically, Domino’s has a compound annual growth rate (CAGR) of global store count growth of 6.6%.

Typically, a restaurant’s business growth is measured by store growth, the higher the number of stores open; the higher the growth, and vice versa.

Interestingly, yesterday, Cowen & Co. analyst Andrew Charles downgraded the DPZ stock to a Hold rating from Buy, and also lowered the price target on the stock to $390 (almost fully valued at current levels) from $480. Following the news, the DPZ stock fell 3.1%, closing at $391.17 on April 5.

According to Charles, Domino’s is expected to open a lesser number of stores in the U.S. as compared to its optimistic outlook. The analyst had a glimpse into Domino’s Franchise Disclosure Document (FDD) given to prospective franchisees. The FDD showcased lower projections of future store openings, which compelled the analyst to lower his forecast for 2022-2024.

Accordingly, Charles now expects Domino’s new stores’ growth to be in line with its CAGR of between 6.2% and 6.5% for 2022 and 2023, at the lower end of the company’s guidance. After Domino’s Q4 earnings miss, several analysts lowered the price target on the stock and a few even downgraded their stance.

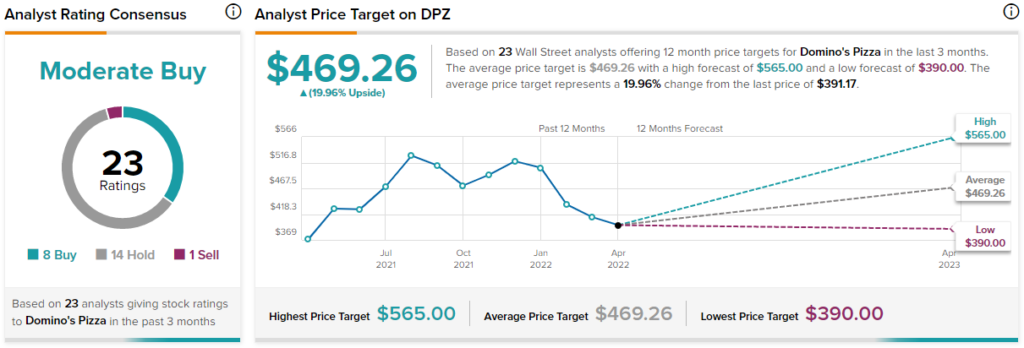

The other analysts on the Street are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys, 14 Holds, and one Sell. The average Domino’s price target of $469.26 implies almost 20% upside potential to current levels.