- Febbraio 28, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

It’s not always easy when a large corporation changes its name as it can often lead to confusion among investors. The latest in this line of big name changes is Paramount (PARA), which is the rebranded recombination of CBS and Viacom and one of largest media conglomerates in the world. CBS television assets included the CBS network, 28 local TV stations, and 50% of CW, a joint venture between CBS and WarnerMedia. The company also owns Showtime and Simon & Schuster. Viacom owned several leading cable network properties, including Nickelodeon, MTV, BET, Comedy Central, VH1, CMT, and Paramount.

The firm’s studio, Paramount Pictures, produces original motion pictures and owns a library of 2,500 films. Paramount+ is one of the company’s key streaming brands.

I am bullish on PARA stock as I believe their investments in streaming content will pay off over the long-term and the company’s low valuation metrics and high dividend yield offer downside protection.

Streaming Business

Paramount+ is one of the fastest-growing streaming channels in the country. That service, along with other niche channels such as BET+, added 26 million subscribers in 2021 to reach a total of 56 million subscribers currently. Streaming subscription revenues increased 80% in 2021. Pluto TV, the company’s multi-channel TV streaming offering, also had good success with over $1 billion in revenues, 64 million monthly average users, and 51% growth in global viewing hours.

The problem with the new world of streaming is content acquisition. Paramount, as well others in the industry, must spend large sums of money to develop or acquire content to be shown on their channels. The company spent $2.2 billion in content expenses in 2021, which is expected to grow to $6.0 billion by 2024. By comparison, Netflix (NFLX) spend $17 billion in content development in 2021.

Financial Results

Paramount reported good results for the 2021 fiscal year, with revenues increasing 13%. Streaming revenues grew 64%, however that represented only 15% of total revenues for the year. Advertising is still the key high margin revenue source for the company and increased 51% for the year.

Adjusted EBITDA decreased to $4.4 billion from $5.1 billion in the prior year due to higher operating and marketing expenses related to the streaming business. The company’s usually high levels of operating cash flow was diminished in the year due to high levels of content spending and came in at only $835 million.

Balance Sheet and Dividend

The company has been successful at reducing debt, which stood at $17.7 billion at the end of 2021, while cash balances were approximately $6.3 billion. The company’s leverage ratio remains below 3.0x.

Paramount pays an annual dividend of $0.96, which equates to a dividend yield of approximately 3.3%.

Valuation

PARA sells at approximately 10x 2022 estimated EPS, however many analysts expect earnings to decline in 2023 due to heavy investments in the streaming business. Using consensus estimates for 2023, the forward P/E increases to 12x.

The company also sells at an EV/EBITDA of approximately 7.6x, which is somewhat in line with competitors (with the exception of Disney (DIS), which trades at unjustifiably high multiples).

Wall Street’s Take

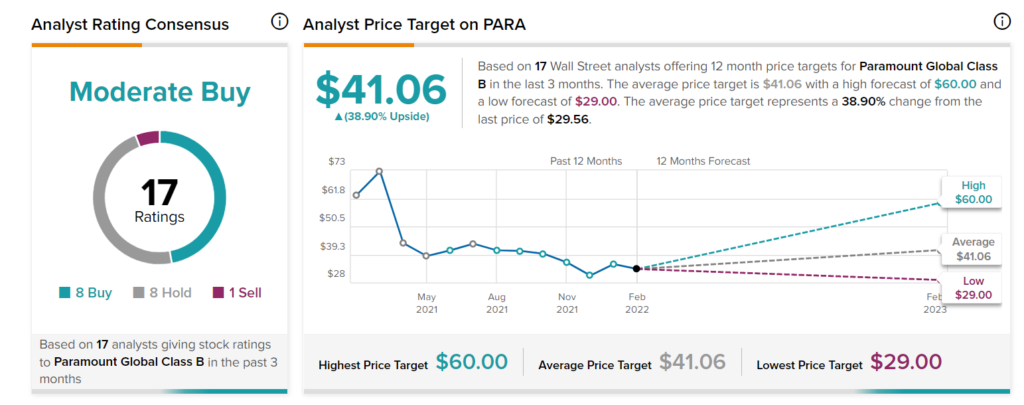

Turning to Wall Street, PARA has a Moderate Buy consensus rating based on eight Buy ratings, eight Hold ratings, and one Sell rating assigned in the past three months. At $41.06, the average PARA price target implies 38.90% upside potential.

Conclusion

I am bullish on PARA stock, as I believe their investments in streaming content will pay off over the long-term and the company’s low valuation metrics and high dividend yield offer downside protection.