- Febbraio 25, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The recent sell-off in the market has led to a pullback in Nvidia (NASDAQ:NVDA) stock. It’s worth noting that Nvidia stock is down about 24% this year despite reporting stellar Q4 financials and providing better-than-expected guidance for the first quarter of the current fiscal year.

Now What?

Nvidia is well-positioned to deliver strong financials due to the ongoing strength across all its end markets, especially Data Center and Gaming. However, Kinngai Chan of Summit Redstone Partners downgraded Nvidia stock to a Hold as he sees risks in the cryptocurrency mining market. Moreover, he stated that the company’s gross margins are close to peaking.

While Chan remains on the sidelines, Credit Suisse analyst John Pitzer is bullish on NVDA stock and sees significant upside from current levels.

Pitzer stated that for NVDA, he sees “the largest TAM (total addressable market) expansion and value grab opportunity in all of Technology.”

Highlighting Nvidia’s growing addressable market, the analyst stated that “while the stock is currently trading at 41.4x CY23 EPS, TAM expansion provides ample opportunity to grow into the valuation and a path to >$10 of EPS in the next 3-5 years is relatively easy to underwrite.”

Pitzer raised his EPS estimates for CY22 and CY23. Further, he reiterated his Buy rating and a price target of $400 (78.7% upside potential).

NVDA Price Forecast

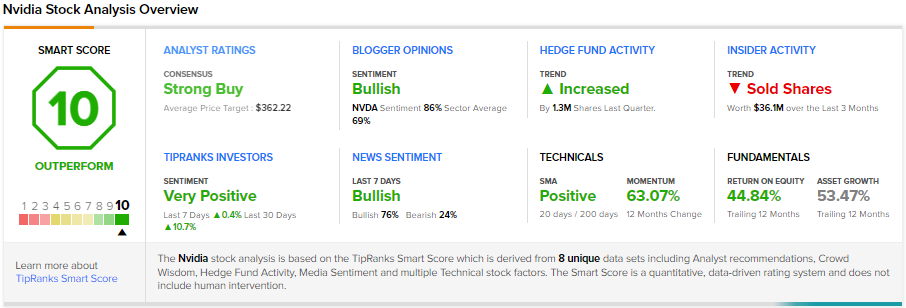

It’s worth noting that investors are buying this dip in NVDA stock. TipRanks’ Investors tool shows that 10.7% of investors holding portfolios on TipRanks have increased their stake in Nvidia stock. Further, hedge funds accumulated 1.3M NVDA shares in the last three months.

Overall, Nvidia stock scores a “Perfect 10” on TipRanks’ Smart Score system, signifying that it could beat the market averages.

Meanwhile, NVDA’s stock price forecast on TipRanks shows significant upside potential. The average Nvidia price target of $362.22 implies 61.8% upside potential to current levels.

Further, most Wall Street analysts are bullish on NVDA stock. Its Strong Buy consensus rating is based on 19 Buy and 3 Hold recommendations.