- Febbraio 15, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Shares of commercial technology company Mercury Systems, Inc. (MRCY) have declined 7.3% so far this year. MRCY caters to the aerospace and defense industries through its open architecture processing solutions. MRCY’s recent second-quarter numbers fell short of expectations on both its top-line and bottom-line fronts.

Revenue increased 4.6% year-over-year to $220.4 million, lagging estimates by $3 million. Earnings per share at $0.39 were lower than expectations by $0.03. Notably, the company witnessed bookings of $237 million, yielding a book-to-bill ratio of 1.08.

During this period, MRCY completed the acquisition of Avalex Technologies and Atlanta Micro, which expanded its content and capabilities in open mission systems and trusted microelectronics. Additionally, management expects significant growth for the fiscal year on the back of anticipated stronger booking levels.

With these developments in mind, let us take a look at the changes in MRCY’s key risk factors that investors should know.

Risk Factors

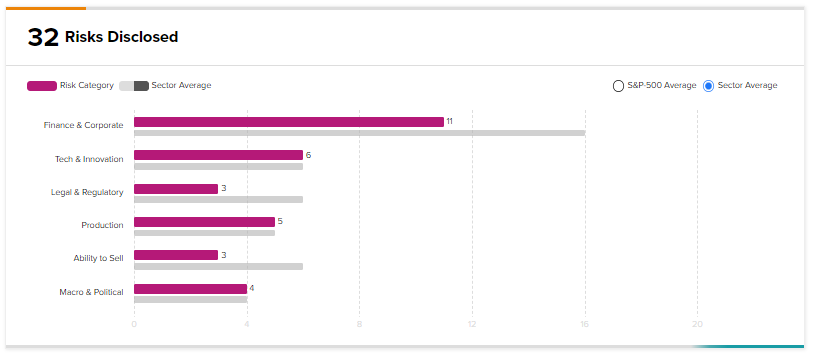

According to the TipRanks Risk Factors tool, Mercury Systems’ top risk category is Finance & Corporate, contributing 11 of the total 32 risks identified for the stock, compared to a sector average of 16 risk factors under the same category.

In its recent report, the company has added one key risk factor under the Finance & Corporate risk category.

MRCY highlighted the risk stemming from shareholder activism, which could mean higher expenses, litigation, and business disruption for the company. MRCY adopted a shareholder rights agreement or ‘poison pill’ on December 27, 2021. Jana Partners LLC and Starboard Value LP have filed a Schedule 13D and have indicated they plan to engage with MRCY’s management.

Furthermore, on January 13, 2022, Starboard also wrote an open letter to MRCY’s board requesting a withdrawal or amendment of the limited duration rights agreement. These factors could also affect the company’s share price.

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have increased holdings in Mercury Systems by 10.2 thousand shares in the last quarter, indicating a neutral hedge fund confidence signal in the stock.