- Maggio 9, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Undoubtedly, the 2021-22 crash in NKE stock is a historic one, and until now, a recovery rally has been quite elusive, with shares now hovering pretty close to a multi-year floor of support. With numerous overlooked catalysts and a historically attractive multiple, I can’t help but stay bullish on the stock as it looks to ricochet a bit higher off that support level around $89.

The latest fumble over MLB player uniforms (they were reportedly see-through and prone to soaking up sweat) may be no laughing matter. However, it does nothing to change the long-term fundamentals, in my view — not with fixes in the cards for the coming season and a slew of new innovations in the pipeline. Indeed, Nike’s return to innovation and the 2024 Paris Olympic games stand out as potential drivers for a stock that’s long overdue to break out of its losing streak.

A Return to Innovation Could Ignite Interest Once Again

The main reason to stick with Nike is not just that the swoosh is a sporty status symbol at the local tennis court, race track, or playground but also that the firm continues to invest heavily to out-innovate its peers.

Swiss footwear firm On Holdings (NASDAQ:ONON) stands out as a competitive threat to Nike and its fairly wide moat. Not only does the On line of runners have a new, stylish, even futuristic look to them, but they perform rather well. And, perhaps most importantly, they won’t break the bank. Only time will tell if On can keep growing as quickly as it has. Regardless, I believe Nike can tilt the odds (and growth prospects) back in its favor as it puts its innovation cap back on.

Sure, many will pay top dollar for an older pair of sneakers with the swoosh on them. That said, the classics can only carry so much weight before consumers look for something newer, fresher, more comfortable, and better performing. Nike CEO John Donahoe has realized this, and he’s committed to working on the firm’s “disruptive innovation pipeline.”

A Stacked Pipeline of Footwear Could Power a Share Price Comeback

With recent new releases like the Air Max DN, a lifestyle shoe that features a redesigned air unit, and, perhaps more importantly, the AlphaFly 3 (the world’s fastest marathon shoe), which has flown off digital shelves, Nike seems to already be on the right track. This success underscores its commitment to innovation.

At almost $300 per pair, the AlphaFly 3 is one of the priciest sneakers in the Nike arsenal. And it’s largely because of the cutting-edge technology under the insole. The Air Zoom unit and ZoomX foam are the innovations that help serious runners gain a leg up over the competition.

With Eliud Kipchoge, one of the fastest marathon runners on Earth, poised to lace up the AlphaFly 3 for the coming Paris Summer Olympics 2024, my bet is that AlphaFly 3 stands to be a hot seller throughout the year. Indeed, the Olympics are a big stage, and Nike is ready to make a statement with its latest and greatest innovations.

Nike’s newest releases show it’s already begun to make a pivot back to innovating. Looking ahead, there’s the Pegasus 41 (coming June 2024), G.T. Hustle 3, and Nike Mercurial to look forward to. Each piece of footwear stands to nudge Nike right back into the spotlight for having the very best footwear, regardless of sport. With such a stacked 2024 pipeline, I’d argue that it’s just a matter of time before the stock itself starts sprinting higher again.

Is NKE Stock a Buy, According to Analysts?

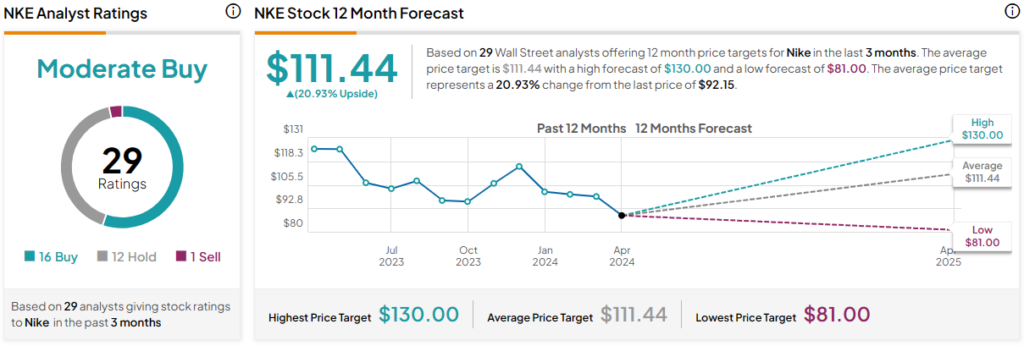

NKE stock comes in as a Moderate Buy. Out of 29 analyst ratings, there are 16 Buys, 12 Holds, and one recommendation. The average NKE stock price target is $111.44, implying upside potential of 20.9%. Analyst price targets range from a low of $81.00 per share to a high of $130.00 per share.

The Bottom Line on NKE Stock

Nike not only needs to prove that it still has the innovation and performance edge over rivals, but it also has to stay stylish with casual users. On all bases, Nike has something new in store for its customers. With the Paris 2024 games up ahead, the stage seems set for Nike to regain its luster and reputation for having the very best gear for performance athletes.