- Maggio 7, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

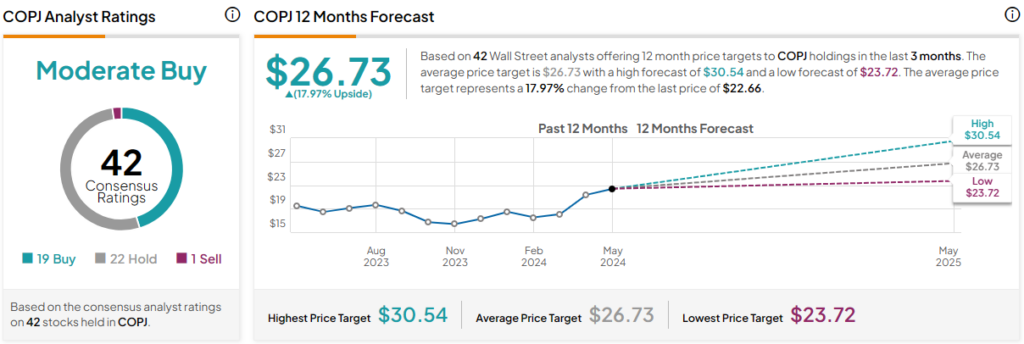

The Sprott Junior Copper Miners ETF (NASDAQ:COPJ) looks attractive, as copper prices recently broke through the $10,000 per ton level for the first time in two years. To be clear, this ETF is not for the faint of heart, as it invests in shares of high-risk, high-reward junior copper miners. It also comes with a hefty price tag in terms of fees and has just $9.4 million in assets under management (AUM). Nonetheless, I’m bullish on COPJ and believe that now could be a good time to invest in junior copper miners.

What Is the COPJ ETF’s Strategy?

According to fund sponsor Sprott, a firm that specializes in the metals and mining space, COPJ invests in an index “designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses.”

Sprott explains that COPJ is “the only pure-play ETF focused on small copper miners,” giving investors exposure to companies “with the potential for significant revenue and asset growth.”