- Aprile 11, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Bullish Analyst’s Opinion

According to the analyst, MU’s performance can be influenced by several catalysts in the near future. The primary factor is Micron’s high-bandwidth memory (HBM) chip technology, which serves as a crucial component in AI servers.

Arya predicts that the HBM market will increase at a compound annual growth rate of 48% by the year 2027 and reach over $20 billion. Also, he believes that Micron is well-positioned to increase its share in the HBM market from less than 5% to the mid-20%, which will drive the company’s revenue to record levels in 2025 and 2026.

Another important factor that the analyst expects can support MU’s growth is the expansion of AI technology into higher-spec smartphones, PCs, and other smart or connected device markets. This is likely to increase demand for the memory chips and keep Micron in the spotlight.

It is worth highlighting that, along with Micron, Arya has identified Marvell Technology (MRVL) and Advanced Micro Devices (AMD) as “junior samurAI” companies that are poised to benefit from the current AI boom. Additionally, Nvidia (NVDA) and Broadcom (AVGO) remain Arya’s top picks in the AI space.

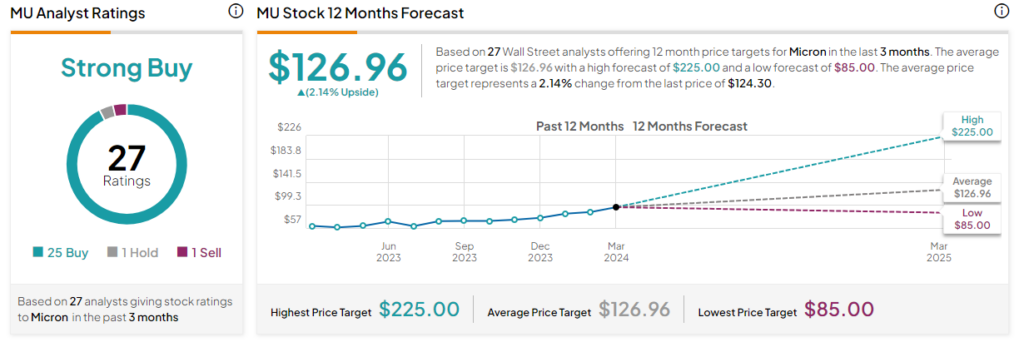

What Is the Price Target for MU?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MU based on 25 Buys, one Hold, and one Sell assigned in the past three months. After a 45.79% surge in its share price so far this year, the analysts’ average price target on Micron stock of $129.96 per share implies a 2.14% upside potential.