- Marzo 19, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

That’s because the company continues gaining market share during a slower cycle for most cybersecurity firms. I am bullish on CrowdStrike, thanks to its positioning in a lucrative industry and the firm’s status as an outlier.

The Importance of Cybersecurity

Cybersecurity software has become necessary due to the rise of online hackers. A cybercriminal can make a lot of money by infiltrating databases and obtaining sensitive information. Some information gets used as blackmail and fuels ransomware attacks, while other hackers sell people’s data on the dark web.

A breach can cost a company millions of dollars and damage customer trust. Many corporations and small businesses don’t want to take those risks, so they pay for cybersecurity solutions instead.

Long-term growth is still strong for the industry. The cybersecurity market is projected to grow at a compound annual growth rate of 12.3% from 2023 until 2030, according to Grand View Research. Some cybersecurity corporations will grow faster than others, and CrowdStrike seems like a company that will outpace most of its competition.

CrowdStrike fulfills the hallmark requirement of every growth stock: high revenue growth. The firm closed out the fourth quarter of Fiscal 2024 (ended January 31) with 33% year-over-year revenue growth compared to the same period last year. This growth rate was consistent with the company’s full-year revenue growth of 36% year-over-year.

CrowdStrike’s annual recurring revenue model makes it easier for the company to build on its successes. The firm now generates $3.44 billion in annual recurring revenue, a 34% year-over-year increase. Moreover, the company added $282 million in new ARR, a 27% year-over-year improvement.

The cybersecurity giant has several ways to unlock additional value. Annual recurring revenue can increase with the existing customer base if CrowdStrike raises prices. Some customers will also upgrade their plans to protect more data. Even without price hikes, the firm is well-positioned to attract new customers.

Profit Margins Are Rising

Another exciting development is the corporation’s rising profit margins. CrowdStrike’s GAAP net income attributable to the business was $53.7 million in Q4 FY2024 compared to a $47.5 million net loss in the same period last year.

The big turnaround resulted in a 6.35% net profit margin. CrowdStrike’s net profit margin in Q3 FY2024 was 3.39%, while the Q2 FY2024 net profit margin came in at 1.16%. CrowdStrike also had a 0.07% net profit margin in Q1 FY2024.

Therefore, CrowdStrike’s margin rose from 0.07% to 6.35% in just a few quarters. With this momentum, the firm can report double-digit net profit margins in future quarters.

The cybersecurity company needs higher profit margins as the stock’s valuation is its primary weakness. The stock’s P/E ratio teeters near 900, but it has a forward P/E ratio of 84.

Investing in CrowdStrike requires a long-term outlook, thanks to the valuation. The underlying business is solid, and higher earnings can result in a more attractive valuation.

Guidance Points to Maintained Growth

CrowdStrike released revenue guidance for Q1 FY2025 and full-year Fiscal 2025. The firm projects $904 million in Q1 FY2025 and $3.957 billion in FY2025 revenue at the midpoints. Those metrics represent 30.5% and 29.3% year-over-year revenue growth, respectively.

Those growth rates are slightly decelerating from last year. However, this guidance comes amid the backdrop of many cybersecurity firms indicating that they will only achieve high single-digit or low double-digit year-over-year revenue growth. CrowdStrike is likely to expand its net profit margins even more while delivering impressive growth.

Is CRWD Stock a Buy, According to Analysts?

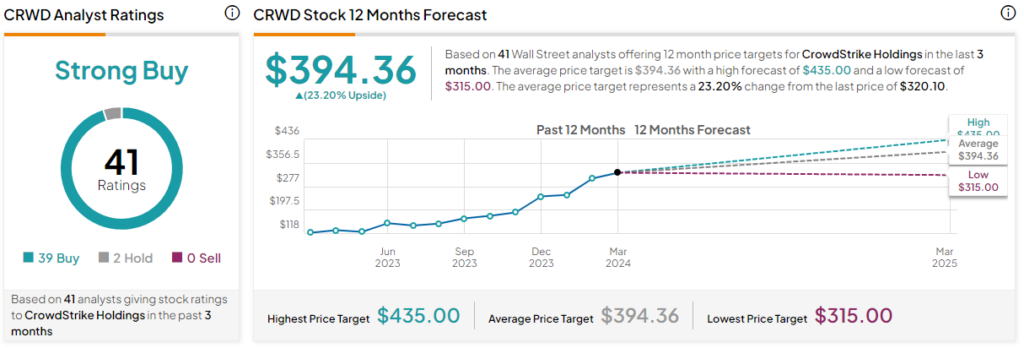

CrowdStrike is rated as a Strong Buy among 41 analysts based on 39 Buys and two Hold ratings. The average CRWD stock price target of $394.36 suggests shares can gain an additional 23.2%. The highest price target of $435 per share implies a 36% gain from current levels.

The Bottom Line on CrowdStrike Stock

CrowdStrike offers robust financial growth and rising profits in an industry projected to grow at 12.3% per year from 2023 until 2030. While other cybersecurity firms are reporting slower growth rates and are reducing guidance, CrowdStrike continues to grow and guides for continued strength. The company’s annual recurring revenue model is a good foundation for long-term success.

CrowdStrike is one of the top cybersecurity stocks in the stock market. Its 140% gain over the past year outperforms the big-name cybersecurity firms. The stock’s only weakness is its current valuation, but expanding net profit margins can address that concern for long-term investors.