- Marzo 18, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Is it a good call to consider Dollar General (NYSE:DG) stock at its current price? Before you make any decisions, take a look at how Dollar General’s main competitor is doing. When all is said and done, I am bullish on DG stock because Dollar General has generated positive results while its main rival has not.

Dollar General runs a chain of retail stores that sells a variety of products at a discount. Shoppers might expect to spend anywhere from $1 to $5 per item at Dollar General.

Dollar General and Dollar Tree: A Tale of Two Discount Retailers

Dollar General’s main competitor is Dollar Tree (NASDAQ:DLTR). Like Dollar General, analysts are moderately bullish on Dollar Tree in the near term. If you really wanted to hedge your bets, you could buy equal amounts of DG stock and DLTR stock.

On the other hand, if one company seems to be in better shape than the other, then it wouldn’t make sense to buy equal amounts of both stocks. Frankly, Dollar Tree’s quarterly earnings results fell short of analysts’ consensus forecasts during the past couple of quarters. In contrast, Dollar General beat Wall Street’s consensus EPS estimates in the two most recently reported quarters.

Come to think of it, the more I look under the hood, the more issues I see with Dollar Tree. Bear in mind that Dollar Tree owns the Family Dollar store brand. In the fourth quarter of Fiscal 2023, Family Dollar’s same-store net sales declined 1.2% year-over-year.

That’s certainly not a good sign for Dollar Tree. It’s also not a good sign that Dollar Tree has identified approximately 600 Family Dollar stores, plus 370 additional Dollar Tree-owned stores, for closure in the first half of Fiscal Year 2024.

This definitely isn’t a signal that Dollar Tree is thriving. Meanwhile, Dollar General didn’t announce any planned store closures in its Q4-2023 report. In fact, the company expects to open 800 new Dollar General locations. It’s entirely possible that discount-seeking shoppers will go to Dollar General stores when the Dollar Tree/Family Dollar locations in their local areas are shut down.

Dollar General Stock: As Inflation Persists, Relax and Collect Dividends

In case you didn’t get the memo, U.S. consumer-price inflation isn’t cooling down as quickly as some people undoubtedly hoped it would. February’s Consumer Price Index (CPI) reading came in higher than economists expected it to. That’s unfortunate for American consumers, but price pressures could drive traffic to discount stores like Dollar General.

With this potential tailwind in mind, Dollar General expects to see current-quarter same-store sales growth of 1.5% to 2% year-over-year, which is modest but attainable. Looking further ahead in time, Dollar General CFO Kelly Dilts anticipates “strong EPS growth in the back half of the year.”

So, maybe despite persistent price inflation—or perhaps even because of it—Dollar General has a slow-but-steady outlook for the coming quarter. Specifically, for Fiscal Year 2024, the company expects to see net sales growth of approximately 6% to 6.7% and same-store sales growth of 2.0% to 2.7%.

It’s fine if Dollar General isn’t expecting blockbuster growth this year. Investors can simply sit back and collect Dollar General’s dividends while they wait. Currently, the company offers a forward annual dividend yield of 1.5%, which is above the consumer cyclical sector’s average annual dividend yield of around 1%.

Is DG Stock a Buy, According to Analysts?

On TipRanks, DG comes in as a Moderate Buy based on six Buys, five Holds, and one Sell rating assigned by analysts in the past three months. The average Dollar General stock price target is $152.36, implying 0.7% upside potential.

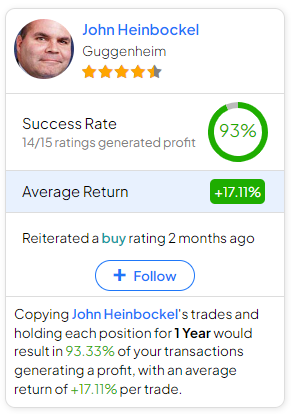

If you’re wondering which analyst you should follow if you want to buy and sell DG stock, the most accurate analyst covering the stock (on a one-year timeframe) is John Heinbockel of Guggenheim, with an average return of 17.11% per rating and a 93% success rate. Click on the image below to learn more.

Conclusion: Should You Consider DG Stock?

As you can see, analysts are moderately bullish on Dollar General stock, much like they are about Dollar Tree stock. Yet, the two companies aren’t in the same situation. As Dollar Tree plans to close stores, Dollar General is preparing to open up new stores. Plus, Dollar General could get more shopper traffic from the areas where Dollar Tree is shutting down its stores.

Therefore, I believe it doesn’t make sense to diversify your portfolio with equal amounts of Dollar General and Dollar Tree stock. There’s a clear winner here, and investors should consider DG stock as Dollar General publishes attainable financial guidance and delivers better-than-average dividends.