- Marzo 7, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Q4 Results: A Review of an Excellent Quarter

Prudent Capital Management

To begin with, in stark contrast to the acquisition spree observed by IIPR from its IPO in 2016 to 2022, the REIT refrained from acquiring any properties in 2023. The year ended with IIPR managing 108 properties in its portfolio, the same as last year, essentially putting a pause on significant expenditure commitments.

I found this to be a very thoughtful decision, particularly considering the ongoing market landscape throughout the year. The surge in interest rates in 2023 would have imposed substantial costs if IIPR chose to raise funds through additional borrowings. Given the specialized and higher-risk nature of IIPR, focusing on cannabis-production properties, creditors might have insisted on highly unfavorable terms, hampering profitability.

Alternatively, seeking funds through equity issuance would have been an even more impractical route. In 2023, IIPR stock featured a yield in the high-single to low double-digits, making the cost of equity for potential acquisitions prohibitively expensive and, therefore, a highly risky venture. For this reason, I appreciate the prudent stance taken by management in navigating these challenges.

With no expansionary efforts concerning IIPR’s management, all focus in 2023 went into ensuring its property portfolio operates smoothly. By that, I mean minimizing the threat of problematic tenants, maximizing rent collection rates, and urging all rental escalations as their underlying leasing contracts allow.

Accordingly, for Q4, despite the lack of any acquisitions to help boost the top line, IIPR achieved revenues and normalized AFFO/share of $79.2 million and $2.28, up 12% and 8%, respectively. It’s interesting to note that despite most REITs seeing their profitability decline in 2023 due to rising interest rates, IIPR’s interest expenses actually declined by 8.2% to $4.15 million for the quarter, since its 2024 and 2026 notes, which comprise almost all of the company’s borrowings, feature fixed interest payments.

I find it impressive that IIPR, despite being perceived as one of the riskier REITs, is consistently posting growing revenues and, more notably, its AFFO per share. It’s sort of paradoxical, given that in this market, even some of the supposedly safer REITs have experienced notable declines in their financials.

Finally, one of the most important highlights of IIPR’s Q4 report, and a strong factor that contributed to bolstering investors’ confidence in the dividend, is that the rent collection for the period was 100%. Given that the company had experienced some tenant issues in the earlier quarters, which I talked about in my previous IIPR article here, seeing collections rebound to 100% is very encouraging regarding the REIT’s overall prospects.

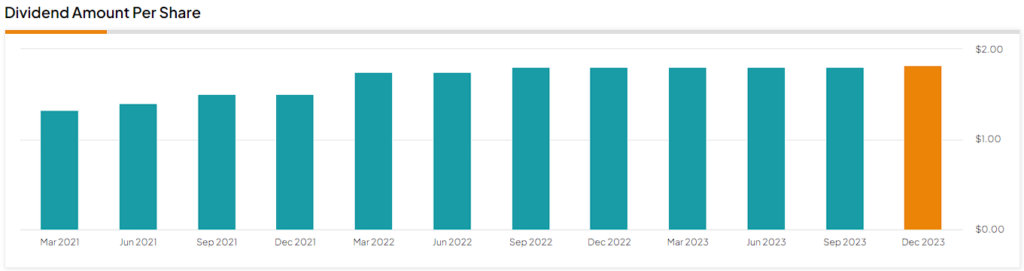

Dividend Increase Silences Dividend Coverage Concerns

In addition to strong results and an excellent rent collection rate, IIPR announced its seventh consecutive annual dividend increase in tandem with its Q4 report. This move by management likely aims to silence any lingering concerns about its dividend coverage. As it’s usually said, the safest dividend is one that has just been raised.

While the 1.1% dividend hike may not be substantial monetarily, it carries weight in making a statement. Given the rather tough real estate environment, it makes sense to see management opting for a soft increase. Nonetheless, the decision to increase the dividend at all signifies confidence in IIPR’s ability to maintain its hefty payouts. In the meantime, the post-hike annualized dividend rate of $7.28 implies a healthy coverage against FY2023’s AFFO/share of $9.08, while the 7.4% yield appears attractive.

Is IIPR Stock a Buy, According to Analysts?

Taking a look at Wall Street’s view on the stock, Innovative Industrial Properties features a Moderate Buy consensus rating based on one Buy and a one Hold rating assigned in the past three months. At $109.00, the average IIPR stock price target implies 11% upside potential.

The Takeaway

To sum up, I believe that IIPR successfully addressed investor worries regarding the underlying health of its dividend. Its Q4 results boasted prudent capital management, strong numbers, and no tenant issues. Finally, management’s decision to once again increase the dividend was the cherry on top in terms of reassuring investors of IIPR’s dividend prospects.

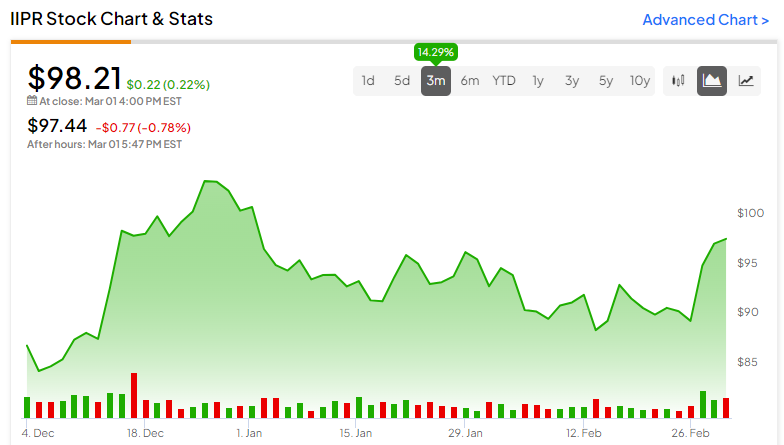

With IIPR’s revenues and AFFO/share treading upwards and the 7.4%-yielding dividend appearing quite attractive, I believe that the ongoing bullish momentum driving shares higher in recent weeks is likely to persist.