- Febbraio 27, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Unpacking WM’s Q4 Results — Record Financials Across the Board

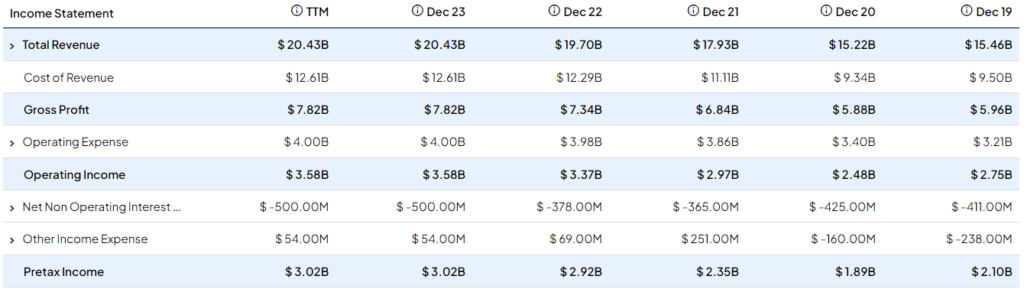

Waste Management’s share price rally is not entirely unjustified. The company’s underlying financials were very strong in its Q4 results, celebrating new revenue, margin, and net income records. Let’s take a look at each metric.

Revenues: Strong Pricing Power Drives Top-Line Growth

Quarterly revenues reached an all-time high of $5.2 billion, up 5.7% year-over-year, driven primarily by core price increases of 7.3%. I praise Waste Management’s ability to raise prices above inflation levels. It basically highlights that management is capitalizing on the essential nature of the company’s business model, which revolves around providing essential waste collection, transportation, and processing services, which are crucial for all communities and businesses.

Despite the year-over-year increase in pricing, Waste Management successfully maintained its full-year churn rates at a commendably low level, standing at about 9%. This rate falls within the lower end of the company’s historical range.

Notably, despite the 9% customer churn, the company more than offset this decline by acquiring new customers and capitalizing on its primary organic growth driver: increased waste production by both people and businesses. This is reflected in the rise of collection and disposal volumes, which increased by 1.1%, or 1.9%, on a workday-adjusted basis compared to the previous year.

Improved Scale, Cost Efficiencies Drove Record Margins

Higher revenues, especially since they were mainly driven by pricing, allowed the company to enjoy improved unit economies. Coupled with cost optimizations and internal efficiency initiatives, Waste Management was able to post record margins across the board.

Regarding benefiting from scaling, Waste Management’s revenue growth translated into full-year operating expenses as a percentage of revenue, coming in at 61.7%, down 70 basis points compared to last year.

Regarding internal efficiencies, I like the example of Waste Management being able to lower repair and maintenance costs by reducing its fleet size, improving fleet age, and cutting down on truck rentals. This way, the company streamlined maintenance processes, making its technicians more efficient and reducing overtime and external repair expenses. Thus, less money was spent on repairs, improving margins.

In particular, Waste Management’s operating EBITDA margin expanded 90 basis points in 2023, reaching 28.9% — a new record. Its operating margin also reached a record 18.7%, up from 17.4% in the previous year.

Record Earnings to be Sustained in FY2024

It’s only natural that with record revenues and margins, the company was able to post record earnings per share of $6.19 for FY2023, a year-over-year increase of 10.7%. This trend is set to be sustained in FY2024 according to management’s guidance, which projects the following:

- Revenue growth between 6% and 7%,

- Adjusted operating EBITDA margin to be between 29.0% and 29.4%, once again set to expand, this time by 30 basis points at the midpoint of this range,

- About $1 billion in share buybacks, which will further assist EPS.

Based on these targets, consensus estimates project adjusted EPS for $6.89 for the year, implying another year of double-digit growth (11.3%) and a new record.

Sudden Valuation Expansion Signals Downside Potential, Nonetheless

While Waste Management’s performance remains quite strong, it’s the sudden valuation expansion the stock has experienced that worries me.

The company maintaining double-digit adjusted EPS growth in 2023 and potentially in 2024 has certainly been a strong catalyst for the stock’s rally. However, recent share price gains have far exceeded earnings growth, which essentially reveals that a multiple expansion has taken place.

Indeed, Waste Management stock is currently trading at a forward P/E of 29.6X, notably higher than the 24x – 27x range the company used to trade in for the better part of last year. The current multiple is also approaching a five-year high of ~31.

Personally, I find Waste Management overvalued here, which could be a cause for headwinds in the share price, moving forward. First, the stock’s current valuation implies a notable premium compared to its historical levels. Further, a forward P/E of 29.6 can hardly be justified on its own with interest rates at 5%+, even when taking into account Waste Management’s double-digit EPS growth and overall qualities.

Is WM Stock a Buy, According to Analysts?

Turning to Wall Street, Waste Management has a Moderate Buy consensus rating based on nine Buys and 10 Holds assigned in the past three months. At $208.61, the average WM stock price target implies just 0.3% upside potential.

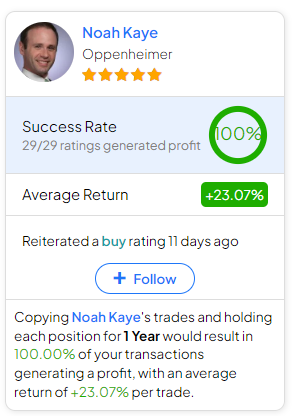

If you’re wondering which analyst you should follow if you want to buy and sell WM stock, the most accurate analyst following the stock (on a one-year timeframe) is Noah Kaye from Oppenheimer, featuring an average return of 23.1% per rating and a 100% success rate. Click on the image below to learn more.

The Takeaway

To sum up, I appreciate Waste Management’s ability to consistently deliver strong results. By achieving record revenues, margins, and earnings in FY2023, the company once again demonstrated the highly attractive qualities of its business model.

However, the ongoing share price rally appears primarily driven by an underlying valuation expansion, which makes me uneasy about downside potential. While the company anticipates sustained growth this year, the stock’s forward P/E of 29.6x stands too rich, in my view. Thus, even though I praise Waste Management for its overall performance and management’s excellent execution, I choose to stay on the sidelines for now.