- Febbraio 20, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Although this move seems to widen consumer options and could be advantageous for Rivian, Deutsche Bank analyst Emmanuel Rosner does not like the sound of it.

“While this move was presented and largely perceived as expanding Rivian’s TAM, especially with the lowest-priced configurations now qualifying for an IRA discount of $3,750, we believe it is in fact a deep price cut without much improvement in cost, which could hurt the company’s financials,” the analyst went on to say.

The new offerings are priced at $74,900 for the Standard version (270 miles with a 106 kWh battery pack) and $78,000 for the Standard+ version (315 miles with a 121 kWh battery pack). The prices represent significant reductions compared to the previously available Large/Max options, which were priced at $84,000/$94,000 respectively and utilized 135 kWh/149 kWh battery packs.

In comparison to the Large pack – the most affordable option just a week ago – the new Standard pack is nearly $9,000 cheaper. However, the reduction in battery pack size is only 14 kWh, translating to a saving of approximately $3,000 in Bill of Materials (BoM) costs. “As a result,” says Rosner, “selling a Standard R1 could generate losses for Rivian that are $6k larger per unit than previously.”

The material price cut without any significant cost benefits is just one of 5 reasons why the new Standard packs are a “negative signal.”

Secondly, it also highlights overall weakening demand for the R1. While this mirrors a broader slowdown in the adoption of EVs and a trend not unique to Rivian, it could have “significant consequences” for the company. Which takes us to the next points. With ASPs heading in the opposite direction than previously targeted, the cheaper options could “push out their path and timeline to breakeven.” Rosner now reckons 2024 gross margin “could be worse than previously anticipated,” predicting that for the full year it will reach -13% compared to -4.3% beforehand.

And that in turn could result in larger FCF burn, given that “the more units sold at a loss, the higher the FCF burn would be.”

Lastly, with the unveiling of Rivian’s next-gen cheaper R2 vehicle set to take place on March 7, there’s the potential for some “positive buzz,” but with production only slated to begin in 2026, there’s the danger of “frustrating customers and of R1 cannibalization.”

“But more importantly,” adds Rosner, “with the timeline to R1 profitability likely pushed out due to deep price cuts, this could raise questions around ability for Rivian to get R2 to profitability at an even much lower price point.”

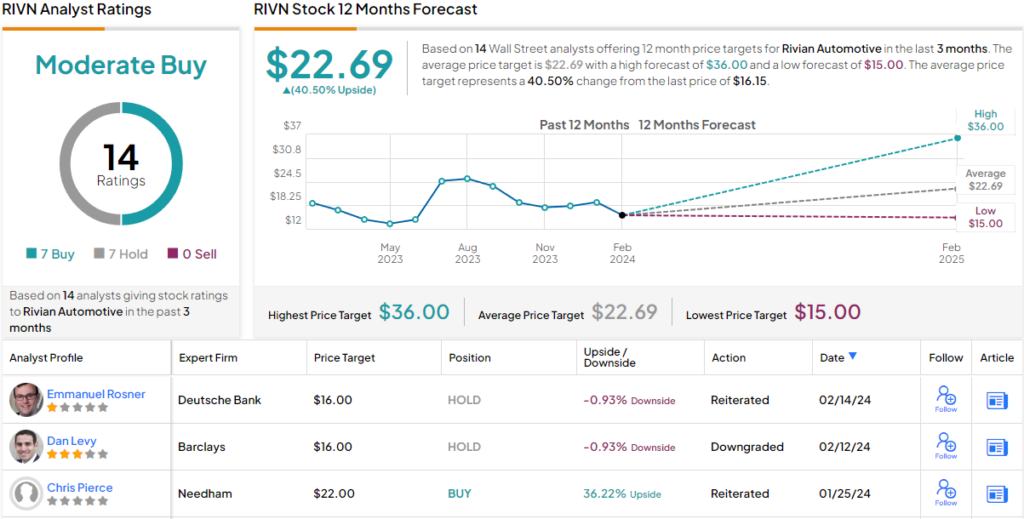

Based on the above, the Deutsche Bank analyst has now lowered his price target on RIVN from $19 to $16, suggesting that the shares will remain rangebound for the time being. Rosner’s rating remains a Hold (i.e., Neutral).

Overall, the RIVN bulls and skeptics on Wall Street are currently evenly matched, with 7 of each, resulting in a Moderate Buy consensus rating. That said, most analysts see the stock as primed for further gains; the $22.69 average target factors in one-year returns of 40.5%.