- Gennaio 31, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Scotland-based NatWest is a banking and insurance company offering personal and business banking, private banking, investment banking, insurance, and corporate finance. Once hailed as Britain’s largest lender, NWG had to be rescued by the U.K. government during the height of the 2008 financial crisis. The government then bought a majority stake (84%) in NWG. It started offloading its shares steadily since March 2022.

More About the Government’s Share Sale Plan

The U.K. government hopes to sell a part of its 36% NWG stake as soon as this summer, once a CEO is named by the bank. Paul Thwaite has been placed as Natwest’s interim CEO until at least July and is one of the most probable candidates to become the permanent CEO. Chancellor Jeremy Hunt announced last November that he plans a share sale in the next twelve months subject to “supportive market conditions and achieving value for money.”

Importantly, the government wants to orchestrate a “Tell Sid”-like advertising campaign. This retro campaign aimed to encourage young investors to buy shares and boost interest in stock markets. The London bourses have lost their sheen lately, with more and more companies preferring to list their stocks on overseas exchanges. Plus, the younger generations are more drawn toward quick-fix ways to wealth, such as cryptocurrencies.

As per a Bloomberg report, the U.K. government has invited proposals from British firms to offload its NatWest stake in a retail offering. Advisory groups have been asked to submit their proposals by February, as the government intends to announce a stake sale alongside its budget on March 6. Reports suggest that the share sale would include a combined offer to the retail public at a discount to the current stock price as well as an offer to institutional investors. This mission could be a problem for the government since NWG shares are already trading at a huge discount to the bail-out price of 2008.

Is NatWest a Buy, Sell, or Hold?

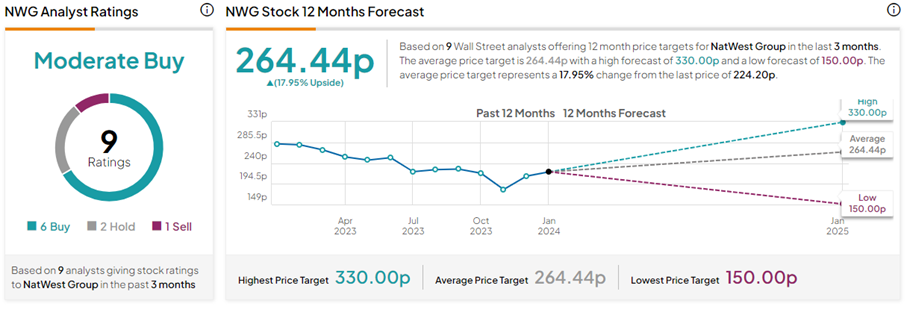

NWG stock has a Moderate Buy consensus rating based on six Buys, two Holds, and one Sell rating. The NatWest Group share price target of 264.44p implies 18% upside potential from current levels. NWG shares have lost over 25% in the past year.