- Gennaio 29, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Rigetti develops quantum computers.

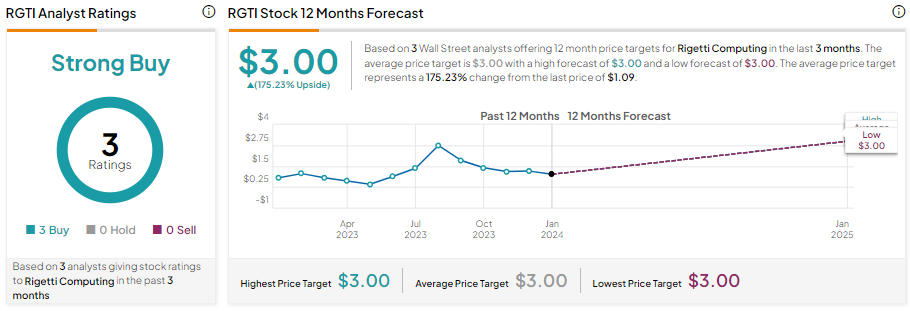

Adding to the optimism, analysts’ average price target suggests significant upside potential over the next 12 months for RGTI stock. Let’s delve deeper.

RGTI – Factors Supporting Growth

RGTI continues to grow its QPU system sales. In the third quarter of 2023, Rigetti expanded its QPU customer base. Notably, this expansion came after the company sold its first QPU systems to Fermilab, a physics and accelerator laboratory, in the second quarter of 2023. Additionally, Rigetti secured a five-year contract with the Air Force Research Lab to provide Quantum Foundry Services.

Furthermore, government agencies and national labs are selecting Rigetti’s fabrication capabilities to advance their quantum computing research and development, which is positive. Moreover, it has reduced its workforce to lower costs, easing pressure on margins.

Benchmark analyst David Williams reiterated the Buy recommendation on RGTI stock on November 15. The analyst believes that growing customer interest and the company’s robust pipeline are positives. Further, Williams expects hardware sales to accelerate in the upcoming quarters.

Is RGTI Stock a Good Buy?

RGTI stock has three unanimous Buy recommendations, translating into a Strong Buy consensus rating. Analysts’ average price target of $3 implies a significant upside potential of 175.23% from current levels.