- Gennaio 24, 2024

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

In terms of earnings, lower sales, higher manufacturing costs related to the planned capacity expansions, and reduced factory loadings weighed on its profitability in Q4. TI posted earnings of $1.49 per share in the fourth quarter, down 30% year-over-year. However, its EPS exceeded the Street’s estimate of $1.47.

Q1 Outlook Fell Short of Expectations

Given the ongoing weakness across its end markets, TI expects its Q1 2024 revenue to come in between $3.45 billion and $3.75 billion, reflecting a year-over-year decline of 14-21%. Moreover, the company’s guidance was significantly lower than the Street’s estimate of $4.05 billion.

Meanwhile, Texas Instrument expects Q1 earnings to come in the range of $0.96 to $1.16 per share, reflecting a year-over-year decline of 37-48%. Further, the EPS forecast came below Wall Street’s expectations of $1.40.

Is Texas Instruments a Buy, Sell, or Hold?

Texas Instruments stock is up about 1.6% over the past year, underperforming the broader market by a wide margin. Notably, the S&P 500 (SPX) gained nearly 21% during the same period.

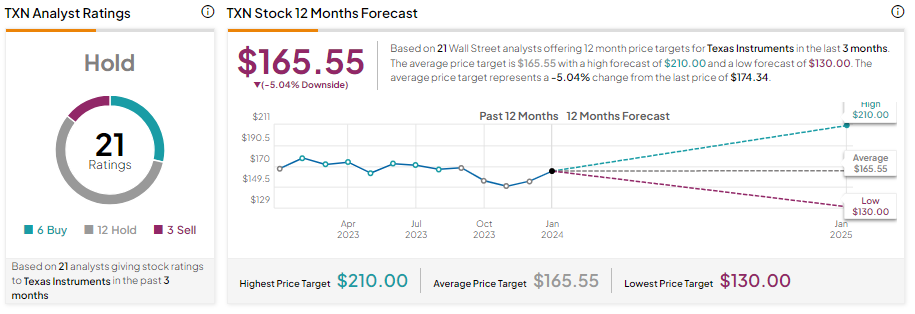

Following the Q4 earnings, Wall Street analysts maintained their ratings on TXN stock. While DBS analyst Ling Lee Keng reiterated a Buy, Joshua Buchalter of TD Cowen maintained a Hold rating on the stock. At the same time, Goldman Sachs analyst Toshiya Hari continues to retain a bearish view of Texas Instruments stock. His price target of $137 implies 21.4% downside potential from current levels.

Overall, Wall Street remains sidelined on TXN stock. Texas Instruments stock has a Hold consensus rating based on six Buy, 12 Hold, and three Sell recommendations. Analysts’ average price target of $165.55 implies 5.04% downside potential from current levels.