- Agosto 7, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Other analysts chimed in with mixed feelings. Citi’s Atif Malik sees a positive catalyst ahead with the new iPhone launch, pointing to Apple’s historical outperformance. J.P. Morgan’s Samik Chatterjee was upbeat, saying the guidance variances were minor and the outlook for FY24 remains strong.

KeyBanc’s Brandon Nispel is more cautious, warning of a potential halt in the upgrade cycle, although he acknowledges that user growth remains a bright spot. However, Rosenblatt’s Barton Crockett was less forgiving, downgrading the stock to neutral. He acknowledged the iPhone’s importance but feared a U.S. slowdown until a significant new product emerges.

What is the Fair Value of Apple Stock?

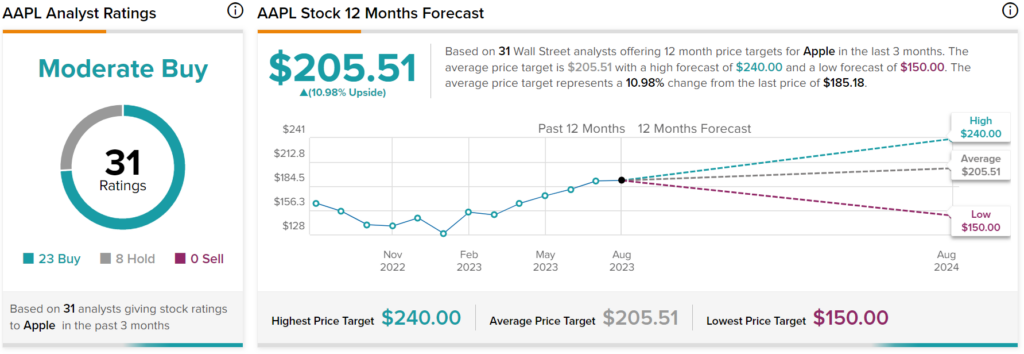

Overall, analysts have a Moderate Buy consensus rating on AAPL stock based on 23 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $205.51 per share implies 11% upside potential.