- Giugno 27, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Alibaba (NYSE:BABA)

E-commerce giant Alibaba has been under pressure over recent quarters due to slower-than-anticipated recovery since reopening, regulatory issues, and intense competition. Nevertheless, the company’s decision to split its massive business into six new groups has sparked hopes of revival and is expected to drive shareholder value.

Last month, Alibaba announced its plans to spin off its cloud division as a newly listed company. This week, the company announced that Daniel Zhang will relinquish his role as group CEO and Chairman to focus on the cloud division. Joseph Tsai, group executive Vice Chairman, will succeed Zhang as group Chairman, while Eddie Wu, current Chairman of Taobao and Tmall, will assume the role of the group CEO. Overall, management shake-up and streamlining efforts are expected to drive long-term growth.

Is Baba a Buy, Sell, or Hold?

Reacting to the announcement, Goldman Sachs analyst James Lee said that the decision reflects improving corporate governance, with a separation of Chairman and CEO positions between the group and subsidiaries.

Further, the analyst noted that some subsidiaries have started the spin-off process “so they could be on a faster track to a public listing.” He added that the new structure unlocks the value of business units and provides a competitive advantage to each business unit. Lee maintained a Buy rating on Alibaba with a price target of $145.

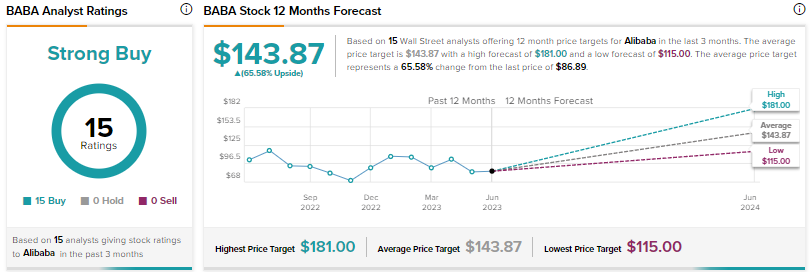

Wall Street’s Strong Buy consensus rating on BABA stock is based on 15 unanimous Buys. The average price target of $143.87 implies about 66% upside. Shares are down 1.4% year-to-date.