- Maggio 3, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

No doubt, there’s not much glamour attached to a company called Advanced Drainage Systems but that doesn’t mean its value proposition isn’t sound.

Advanced Drainage Systems offers water management solutions and drainage products for use in the construction and agriculture sectors, namely the $6 billion stormwater and $1 billion onsite septic wastewater industries. Its product line includes plastic leach field chambers and systems, septic tanks, polypropylene and polyethylene pipes, water filters and water separators, amongst a host of other offerings.

Over the past 12 years, the company has noticeably bettered end-market growth (non-residential market by +10%, residential by +6%). That said, there was no top-line growth on tap in the company’s most recently reported results – for the fiscal third quarter of 2023 (December quarter). Revenue dropped by 8.4% year-over-year to $655.2 million, missing consensus by $58.37 million. Adjusted EBITDA also fell by 3.6% to $169.7 million. On the other hand, Gross profit rose by 7.1% to $223.9 million and net income climbed 11.7% to $83.2 million. However, at $0.99, EPS still fell short of the $1.22 forecast.

The soft results are no turn off for Oppenheimer’s Bryan Blair. The 5-star analyst recently initiated coverage of WMS and sees plenty to like about the company.

“The team’s comprehensive product portfolio, unmatched scale and resource support (including an expansive sales network, engineering staff, and company-owned fleet of 700 trucks and 1,250 trailers), and the continued material conversion (favoring plastic) of stormwater and septic systems all bode well for sustained outperformance,” Blair wrote. “Although construction-driven stocks remain generally out of favor (particularly those with non-res concentration), we view near-term estimate risk as well understood with solid, likely underappreciated upside potential over F2H24-FY25.”

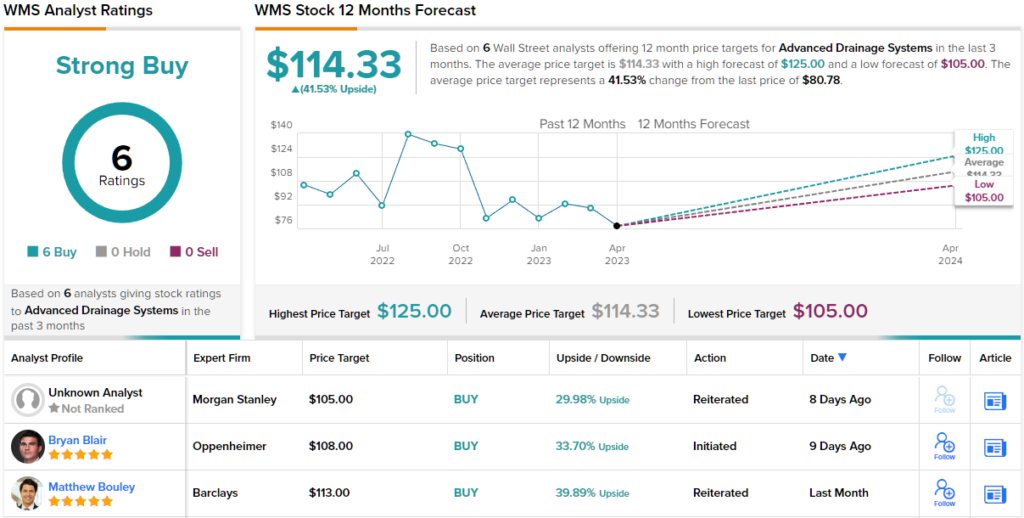

These comments form the basis for Blair’s Outperform (i.e., Buy) rating on WMS, while his $108 price target implies one-year share appreciation of ~34%.

Overall, Wall Street likes this drainage solutions stock. All 6 recent analyst reviews are positive, making for a Strong Buy consensus rating. Going by the $114.33 average target, the shares will surge ~41% in the months ahead.