- Maggio 2, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The first Oppenheimer-backed stock we’ll look at is an ophthalmic medical device company that has notched a big achievement. RxSight has developed and commercialized the world’s first adjustable intraocular lens (IOL) that allows for customization following cataract surgery. The FDA-approved proprietary RxSight Light Adjustable Lens system includes the Light Adjustable Lens (LAL) and the Light Delivery Device (LDD).

How does the RxSight system work, then? The LAL is implanted using a typical cataract process, refractive error is determined with patient input when healing is complete, and the LAL is then reshaped using the LDD with the precise amount of visual correction required to produce the patient’s preferred vision outcomes.

The company has been showing consistent top-line growth and that was on offer again in RXST’s latest quarterly readout – for 4Q22. Revenue reached $16.1 million, amounting to 91.7% year-over-year growth whilst meeting Street expectations. On the bottom-line, Adj. EPS of -$0.45 came in well ahead of the expected -$0.74. Looking ahead, the company guided for 2023 revenue in the range between $78 to $83 million, suggesting growth of 59% to 69% vs. 2022. Consensus was looking for $77.24 million.

The novel IOL tech has caught the attention of Oppenheimer analyst Steven Lichtman, who sees room for more growth ahead.

“Of the ~4.5M US cataract procedures, premium IOLs like RXST’s LAL account for +/-20%. We look for continued expansion of the premium IOL market over the next few years as the technology has improved and patients look for spectacle independence,” the 5-star analyst explained. “While there are risks to LAL adoption (high out-of-pocket cost, need for follow-up visits for adjustments), our survey work shows increasing interest and utilization in the technology from both current users and those looking to adopt near term. We see a path to meaningful gross margin expansion for this razor/razorblade story.”

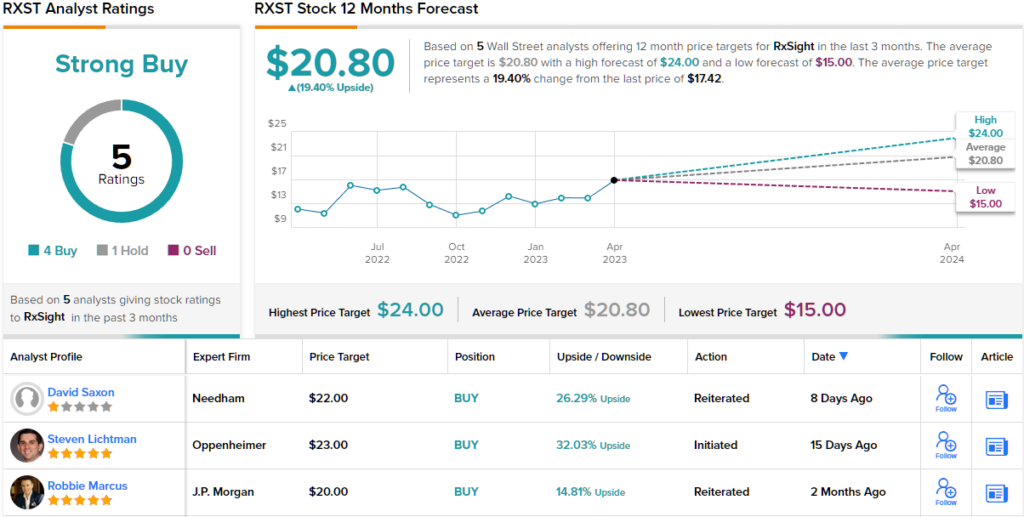

How does this translate to investors? Lichtman rates RxSight shares an Outperform and backs that up with a $23 price target. That figure implies 32% upside potential from current levels

Looking at the consensus breakdown, while one analyst remains on the sidelines, all 4 other analyst reviews are positive, providing this stock with a Strong Buy consensus rating. The Street sees shares climbing by 19% in the months ahead, given the average target clocks in at $20.80.