- Aprile 14, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The first Englander-backed stock we’ll look at is Golar LNG, a company that provides liquefied natural gas (LNG) transportation services. That is, Golar designs, constructs, owns and oversees marine infrastructure – or, floating liquefied natural gas (FLNG) facilities – that transforms natural gas into LNG and LNG back into natural gas. As an industry leader in the development of floating terminals, the company prides itself on producing more LNG from a floating facility than any of its competitors.

That said, it has not all been plain sailing recently with the company delivering a mixed 4Q22 report. Revenue fell by 48.6% year-over-year to $59.14 million, and at the same time came in $8.74 million below expectations. On the other hand, Q4 net income of $71 million came in some distance above the $8 million generated in the same period a year ago, while adjusted EBITDA of $87 million compared well to the $56 million delivered in 4Q21.

Englander must think the positives far outweigh the negatives here. In Q1, he bought 1,974,028 shares, and now holds 5,216,087 in total. His current ownership stake in the company stands at 4.9% and amounts to over $110 million.

The hedge magnate is not the only bull here. Assessing the company’s prospects, Stifel analyst Benjamin Nolan thinks the stock is currently undervalued.

“In our view, Golar has done just about everything right over the course of the past year… The company has strengthened the balance sheet and invested counter-cyclically, but still, shares have languished in the past six months because the promised growth in new projects has simply not materialized. Consequently, GLNG shares are trading well below liquidation value. The company is proactively pursuing an incremental project which we believe could catalyze shares and at these values, we believe there is very little downside risk,” Nolan explained.

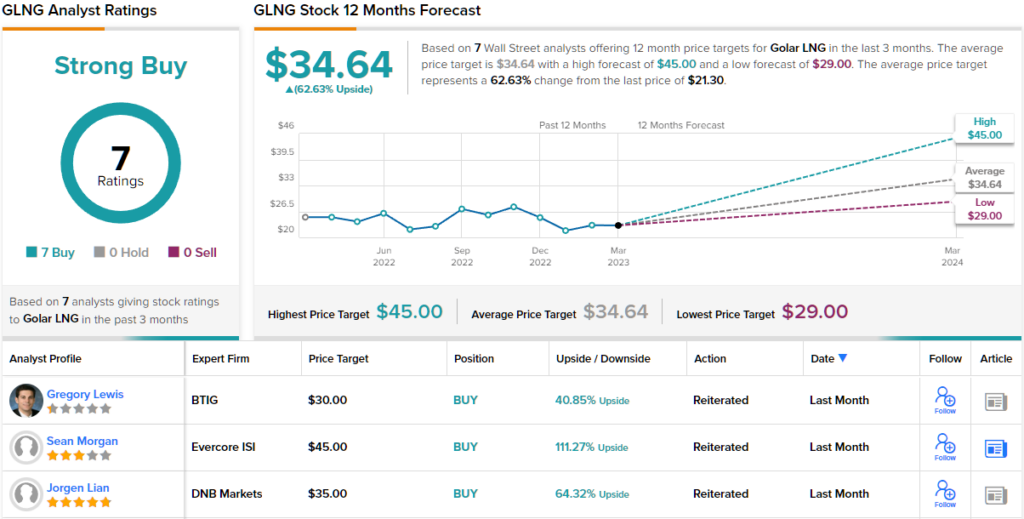

These comments form the basis for Nolan’s Buy rating on GLNG, while his $35 price target suggests the shares will climb 64% higher in the year ahead.

Other analysts are no less enthusiastic; based on Buys only – 7, in total – the stock claims a Strong Buy consensus rating. The $34.64 average target is only slightly lower than Nolan’s objective and implies ~63% upside from current levels.