- Aprile 3, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Altria Group is one of the world’s largest cigarette makers, and owns the well-known Marlboro brand. While the company has built itself into one of the world’s major public firm through the tobacco industry, in recent years it has begun to diversify beyond just cigarettes and other tobacco products. While a diversified product line is usually beneficial, in Altria’s case it provides a cushion against changing social and political winds that no longer favor the core tobacco product lines.

Specifically, Altria has been making moves into the smokeless tobacco realm, and into the e-cigarette, or vaping, sector. To that end, the company announced early in March that it had entered a ‘definitive agreement’ with NJOY Holdings, with particular attention to gaining ownership of NJOY portfolio of e-vape products. Altria has reportedly agreed to pay up to $2.75 billion in cash at transaction closing, and up to an additional $500 million in cash pending regulatory outcomes on some part of NJOY’s products. Backing the deal, Altria notes that last year there were 9.5 million adult vape users in the US, and the market for vapes reached $7 billion in US sales.

In addition to shifting toward smokeless products, Altria has also made some major strategic investments, and holds a 10% stake in AB-Inbev, a major name in the brewing industry. Altria also holds 41% ownership of Cronos Group, a major operator in the Canadian cannabinoid market.

On the financial side, Altria last reported quarter – 4Q22 – showed mixed results. The company had net revenues of $6.1 billion, down 2.3% year-over-year, and an adjusted diluted EPS of $1.18, up 8.3% y/y. The revenue figure missed the forecast by $70 million, while the EPS was ahead of expectations by 1 cent.

In 4Q22 Altria reported the completion of its previously authorized $3.8 billion capital return program of share repurchases – and authorized an additional $1 billion in repurchases to continue the returns. The company also paid out $1.7 billion in dividends during Q4, part of the $6.6 billion paid out in the full-year 2022. For fiscal years 2018 through 2022, Altria has paid out over $30 billion in dividends, and repurchased more than $6 billion in stock shares.

The current dividend, scheduled for an April 28 payment, is set at 94 cents per common share. With an annualized rate of $3.76, the dividend yields an impressive 8.4%, more than 4x the average div yield found on the S&P 500. Altria has kept up reliable dividend payments since 1989.

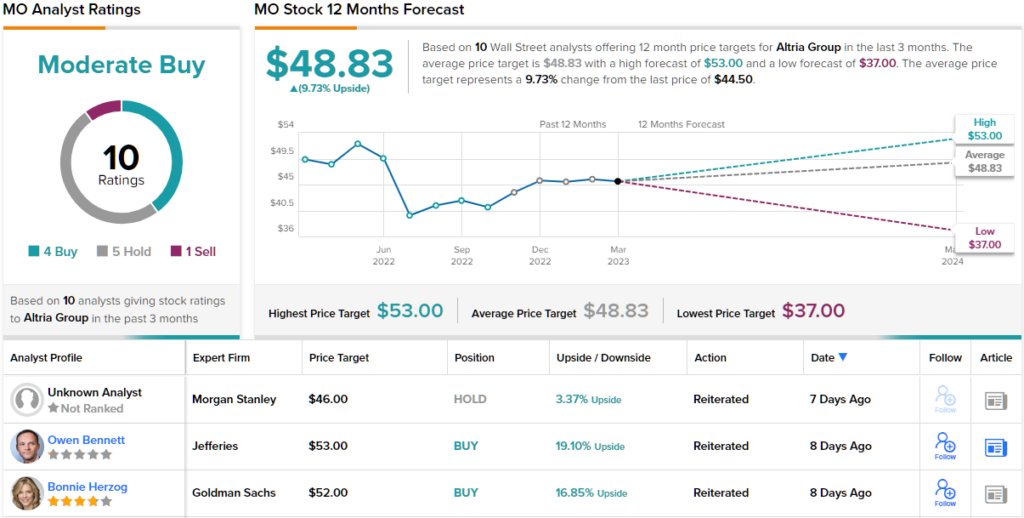

Goldman analyst Bonnie Herzog takes an unequivocally bullish position on Altria, writing of the stock: “We continue to recommend MO’s stock as we have strong conviction that it will be able to comfortably deliver on its MSD EPS growth target for FY23 and MSD CAGR through FY28. Furthermore, we believe MO is among the best positioned in uncertain/recessionary markets, and we see limited downside risk given MO’s strong underlying FCF, lack of FX exposure, attractive and expanding gross margins, attractive valuation, and a strong balance sheet with a focus on shareholder returns and a very attractive dividend yield…”

Along with this upbeat stance, Herzog gives MO shares a Buy rating and a $52 price target that implies a one-year potential gain of ~17%.

Overall, Altria gets a Moderate Buy rating from the analyst consensus, based on 10 recent Wall Street reviews that break down to 4 Buys, 5 Holds, and 1 Sell.