- Marzo 21, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Argenx is a biopharma firm in the immunology niche, working on new treatments for rare diseases.

The company has an extensive pipeline, with nearly 20 separate research tracks investigating the uses and efficacy of 3 different drug candidates.

The leading candidate, efgartigimod, has received approval in the US, Europe, and Japan for the treatment of the rare neuromuscular disease gMG, and the company was focused in 2022 on launch activities for the medication, branded as Vyvgart.

In its 2022 annual report, Argenx gave updated information on the Vyvgart launch. Worldwide, the company notes that there are some 3,000 gMG patients on Vyvgart, and that the drug generated a full-year net product revenue of $400.7 million. In addition, the company is following regulatory processes in multiple countries, including China, the UK, Canada, and Italy, preparatory to additional approvals and commercial launches.

Argenx is also putting efgartigimod through additional clinical trials, for label expansion purposes. These trials are at various stages, with the ADAPT-SC trials being the most advanced. This completed trial was for a neurological application, gMG in adult patients, of the drug, and the company, based on positive topline data, received FDA acceptance of the biologics license application with a PDUFA date of June 20, 2023.

The company’s ADHERE trial, a registrational clinical trial in the treatment of chronic inflammatory demyelinating polyneuropathy (CIDP) is on track to release topline data in 2Q23, and the registrational Phase 2/3 ALKIVIA trial, studying efgartigimod in the treatment of three subtypes of idiopathic inflammatory myopathies, is ongoing. Argenx even has a registrational clinical trial planned for the treatment of thyroid eye disease (TED) planned for initiation in 4Q23.

While we have outlined just the tip of the iceberg on Argenx’s extensive pipeline, these programs are at the heart of the Baird analyst Joel Beatty’s assessment of the stock. Beatty writes: “We now see this as a good entry point into the stock, ahead of what we anticipate will be successful registrational trial results for CIDP in 2Q23 (which could reintroduce a strong acquisition premium into the stock). Also, we anticipate efgartigimod sales for gMG will continue to grow at a good rate, bolstered by SQ formulation approval in June.”

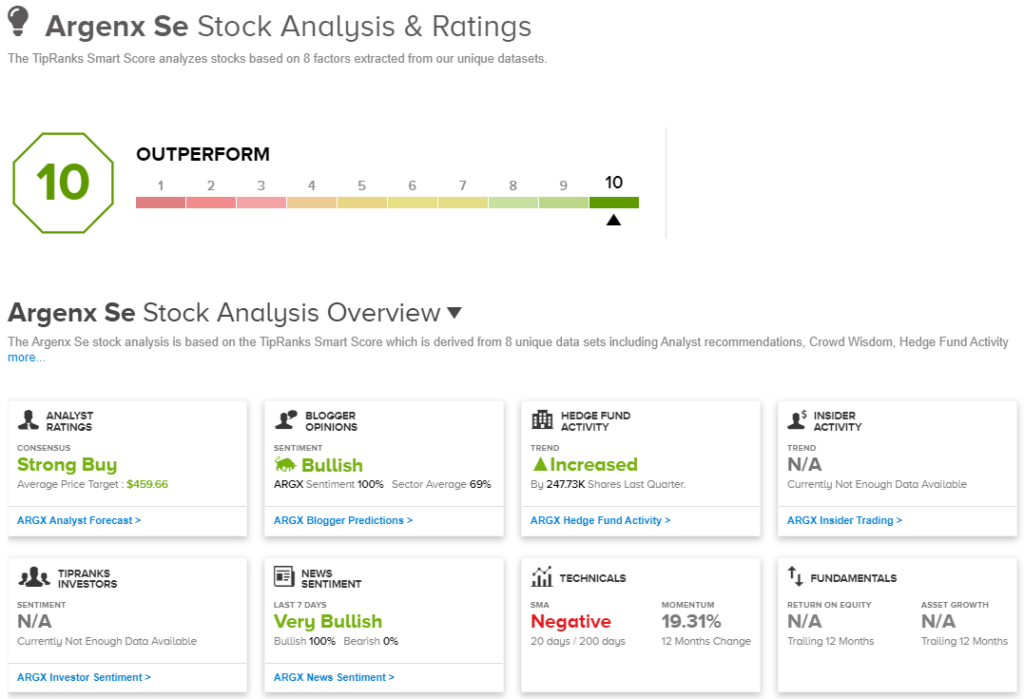

In his view, ARGX shares deserve an Outperform (i.e. Buy) rating, and his $460 price target suggests the stock has room for a 28% upside in the year ahead.

The Strong Buy consensus rating here shows that the bull are out in force, as evidence by the 15 to 1 breakdown of the 16 recent share reviews, favoring Buys over Holds.