- Marzo 20, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

We’ll start in the solar energy industry, with Array Technologies. This company specialized in solar tracker technology, the combinations of hardware and software needed to keep utility-grade photovoltaic panel arrays properly aligned with the sun, for maximum efficiency.

Array’s flagship product, the DuraTrack system, is used in large-scale solar power projects, the types connected to public power generation utilities, and is considered a leading system in the solar tracker field.

Cutting edge companies in rapidly expanding fields will frequently run net losses – and as recently as 2H21, Array was not a net-profitable company. Starting in 3Q22, however, the company turned a corner, and achieved both record revenues and profitability.

In Q3, Array posted a company-record top line of $515 million, up from $188.7 million in the prior-year period, and a net income to common shareholders of $28.6 million, compared to the 3Q21 loss of $33. The company’s EPS, at 19 cents per diluted share, beat the 11-cent forecast by a 72% margin and was a dramatic turnaround from the 7-cent EPS loss recorded one year earlier.

Array will report its Q4 and full-year 2022 results on March 21. In the meantime, the company has released preliminary financial results and guidance. Arrays is guiding toward $1.62 billion to $1.64 billion in total revenues for 2022; achieving this would represent a 73% year-over-year revenue increase from the $941 million reported in 2021. The company had $1.9 billion on its order book as of December 31, 2022.

Looking forward, Array is predicting 2023 total revenues in the range between $1.8 billion and $1.95 billion, with a full-year adjusted EPS of 75 cents to 85 cents.

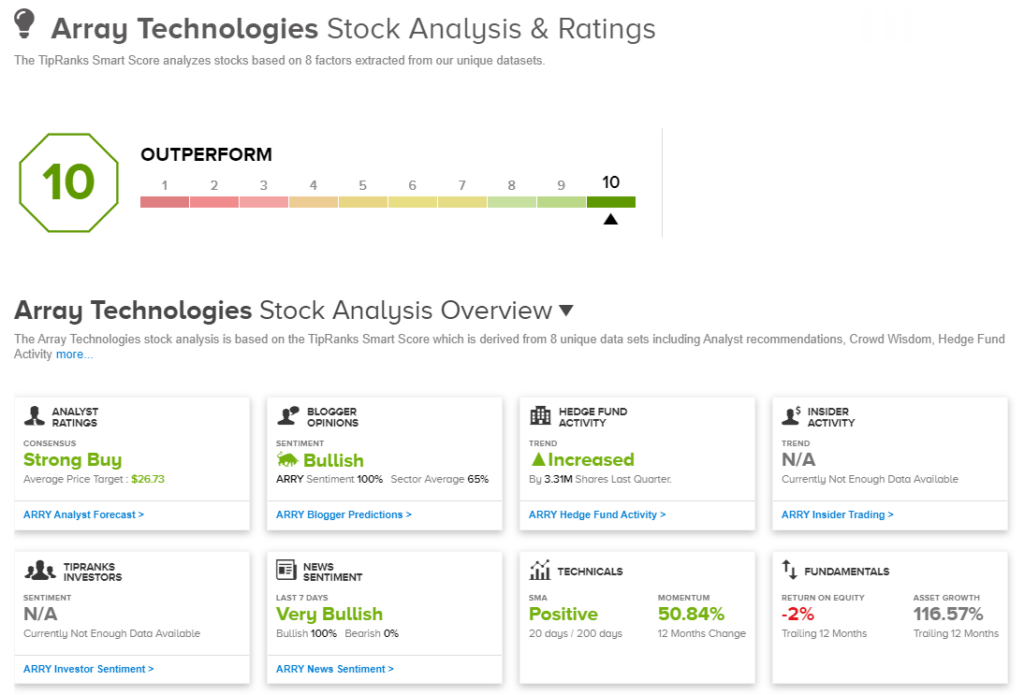

Scotiabank analyst Tristan Richardson covers this stock, and looking at the company’s recent trendlines he takes an unequivocally bullish stand.

“Array is a direct play on the global secular growth trends in utility-scale solar capacity, with its ground-mount tracker product. While near-term uncertainties remain on project timing, related to module availability for developers, in the long term, we look for 15%-20% solar capacity growth, which offers Array a strong secular backdrop as well as the potential for increased market adoption of tracker solutions generally,” Richardson opined.

To this end, Richardson rates ARRY shares an Outperform (i.e. Buy), and his price target, of $26, indicates potential for 52% upside in the coming months.

The bulls are definitely on the run for ARRY, as the stock has 12 recent analyst reviews with a 10 to 2 breakdown favoring Buys over Holds – for a Strong Buy consensus rating. The shares are priced at $17.07 and the average price target, $26.73, implies ~57% upside by the end of this year.