- Marzo 16, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

With inflation at 6.4%, many investors are looking for investments that can beat the rate of inflation. The Global X Super Dividend ETF (NYSEARCA:SDIV) not only helps investors beat inflation, but it more than doubles it with a massive dividend yield of 14.3%.

SDIV also holds additional appeal to income-seeking investors because, unlike many other dividend stocks and ETFs, which pay dividends quarterly, this ETF pays a dividend each month.

However, there are also some potential drawbacks that investors should be aware of. Let’s dive into the ins and outs of this ETF with an eye-popping yield.

SDIV ETF’s Strategy

SDIV seeks to correspond generally to the results and yield of the Solactive Global SuperDividend Index before fees and expenses. Its strategy is to invest in some of the highest-yielding dividend stocks worldwide.

Investing in these high-yield stocks gives SDIV a 14.3% yield that is double the rate of inflation, nearly nine times the average yield of the S&P 500 (SPX), and more than three times the risk-free return that investors can earn from 10-year treasuries.

There’s something to be said for SDIV’s track record when it comes to the consistency of its dividend — since its inception in 2011, SDIV has made a monthly dividend payment each month for 11 years in a row.

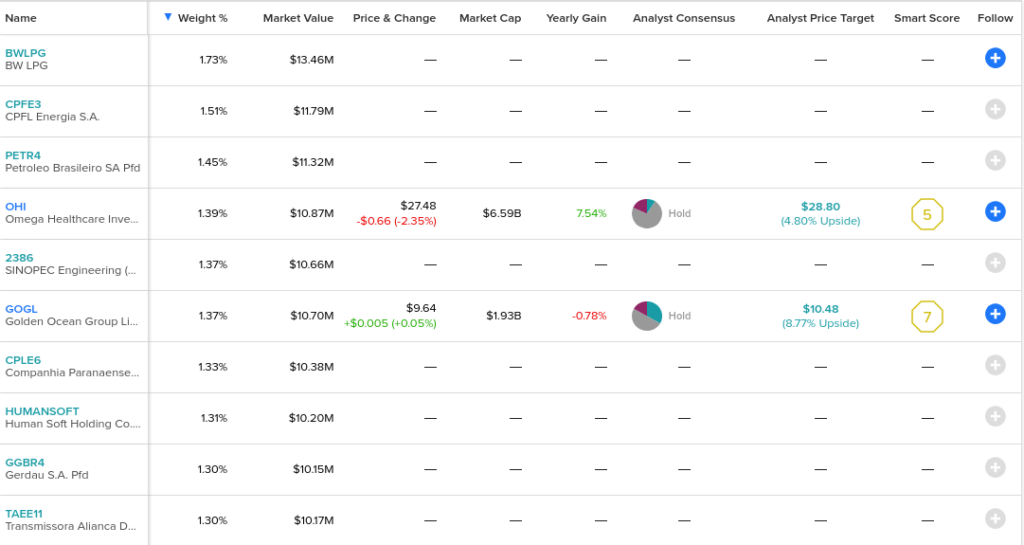

SDIV’s Top Holdings: Spanning the Globe

SDIV is extremely diversified. It holds 130 stocks, and its top 10 holdings make up just 13.9% of assets. Also, no holding accounts for more than 1.7% of the fund. Additionally, SDIV’s holdings are further diversified — both geographically and in terms of what industries they hail from.

Only 29.7% of the fund’s holdings are based in the United States, so if you are a U.S. investor looking for international exposure, SDIV gives you that in spades. The fund’s second-largest exposure geographically is Brazil (14%), followed by Hong Kong (11.2%), China (9.7%), and Great Britain (6.0%). The ETF’s high level of investment in international equities gives it a lot of diversification, but it has also been a headwind in recent times as the strong dollar has been a challenge for international stocks.

One additional note on geography is that while having an exposure of over 20% to China and Hong Kong combined was a headwind last year due to China’s zero-COVID policy, this exposure could be a tailwind this year as China emerges from these lockdowns.

China is also one of the few major global economies currently easing monetary policy. China’s central bank is injecting liquidity into domestic markets to stimulate economic activity, which could give SDIV a boost, going forward.

Many of SDIV’s top holdings are names that may not be immediately familiar to most investors. The top holding, BW LPG, and fellow top 10 holding, Golden Ocean (NASDAQ:GOGL), are both involved in the shipping industry. BW LPG yields a whopping 14.7%, and Golden Ocean yields 17.1% on a trailing-12-months basis. BW LPG is based in Singapore, and Golden Ocean is based in Bermuda, highlighting the disparate nature of SDIV’s holdings.

Top 10 holding Omega Healthcare Investors (NYSE:OHI) is a U.S.-based healthcare REIT that yields 9.8%. Another top 10 position, Arbor Realty (NYSE:ABR), is a U.S.-based company investing in structured financial products in the real estate market. ABR shares currently yield 12.2%.

Energy is an industry associated with high dividend yields, so it is unsurprising that it’s well-represented in the Global X SuperDividend ETF through holdings such as Brazilian oil giant Petrobras (NYSE:PBR) — although note that these are preferred shares of Petrobras, not the common equity — Antero Midstream (NYSE:AM), and Diversified Gas & Oil (LSE:DEC).

See below for an overview of SDIV’s top holdings

Risks to Consider

While SDIV’s 14.3% yield is hard to beat, this ETF is not without its risks that investors should be aware of. These risks are borne out by the fund’s performance over the recent past, which I’ll highlight in the next section. Nonetheless, as you can see from the list of holdings above, there aren’t many blue-chip names here.

When stocks have yields this high, in many cases, it can be a sign that something is wrong and that the market does not believe that the dividend payout is sustainable. Most companies aren’t setting out to have a 14% dividend yield, so in many cases, a high yield like this can be the sign of a falling stock price.

It goes without saying, but investors want to find stocks with an attractive dividend yield because the dividend payout is increasing year after year, not because the stock price is declining over time.

A quick look at some of SDIV’s holdings illustrates this point. Shares of Golden Ocean have declined by nearly 75% over the past decade, while shares of Omega Healthcare Investors have done better but have still lost 4.7% over the same time frame.

Investors who chased the high yields in these names not only drastically underperformed the broader market over the past 10 years but, in the case of Golden Ocean, also lost a significant amount of their principal.

Omega Healthcare Investors and Golden Ocean feature Smart Scores of 5 and 7 out of 10, respectively, so the market is neutral on their prospects from here.

SDIV’s Performance

SDIV is lagging the broader market year-to-date with a 3.7% loss versus a gain of 1.3% for the S&P 500. SDIV also lost 26.4% in 2022, which was a bit worse than the S&P 500.

Over the past five years, SDIV is down 63.5%, and over the past decade, it’s down 67%. Meanwhile, the S&P 500 is up 38.8% and 147.5% over the past five and 10 years, respectively.

So, while SDIV holders collected some attractive dividend payouts over the years, the value of their investment went down significantly over time and underperformed the broader market. Investors also had to pay an expense ratio of 0.58% each year during this time.

Investor Takeway

SDIV’s massive 14.3% dividend payout is very appealing for income-oriented investors, and its monthly payout schedule burnishes this appeal. However, there aren’t many blue chip holdings here, and the ETF’s performance over the past decade hasn’t been great.

This isn’t to say that the ETF can’t outperform from here, and SDIV also deserves credit for its 11-year streak of monthly payouts, but investors should be aware of the potential risks.

This is why investors who are interested in SDIV and in generating some significant income from their portfolio on a monthly basis would be best served making SDIV one component of a well-diversified portfolio. Investors could, for example, boost the yield of their portfolio by adding a allocating a small portion of it to SDIV, but I would be cautious about making a large allocation to it based on the factors discussed above.