- Marzo 1, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

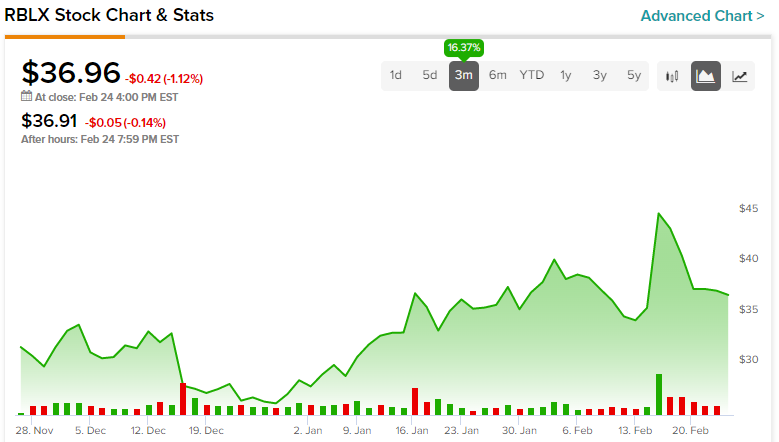

Roblox (NASDAQ:RBLX) stock is back on the retreat following an ugly market streak that began following the release of some hot inflation numbers. With renewed fears of the Fed, it seems like hyper-growth stocks are in for more tough sledding ahead. Still, Roblox continues to stand out as one of the growth stocks that will rise again.

Like it or not, the popular video game platform is probably the closest thing to the metaverse that we’ve got today. Nevertheless, I’m sure that Meta Platforms (NASDAQ:META) would argue its Horizon Worlds and Crayta environments better represent what to expect from the digital worlds of the future. As Roblox continues to move through one of the most challenging environments in its history, I remain bullish.

It’s always hard to value hyper-growth stocks. With growth taking a hit from macro headwinds while multiples contract across the board, evaluating a name like Roblox has become that much harder. Indeed, it’s hard to see how the impressive user base will translate into profits many years down the road.

Regardless, I think Roblox has proven it’s more than just a video game company; it’s a growing ecosystem of digital experiences. As these experiences get richer, I believe it will be tough for rivals (like Meta Platforms) to catch up.

Roblox: Its Network is a Source of its Moat

Ultimately, Roblox stands out as a firm that could benefit greatly from network effects as the platform looks to “grow up” alongside its mostly youthful user base. As long as developers keep creating on the platform, users are likelier to stick around rather than “upgrade” to more video games with more advanced graphics and gameplay.

Undoubtedly, Roblox has proven it’s not just a game that one can put down; it’s a means of visiting many “places” in the digital world that one could refer to as “the metaverse.” Indeed, when we hear of the metaverse, many envision something far more advanced and immersive. Until the hardware can get in a place for such a metaverse to take off, I’d argue that Roblox will continue to be the best way to play the metaverse trend.

After being weighed down by macro headwinds for most of 2022, Roblox showed signs of relief in its fourth quarter. The company saw 58.8 million global daily active users (DAUs), up from the 49.5 million users it had over the same period last year.

Most remarkably, the company’s user base seems to be getting older, with more than 55% of users now older than 13, up from around 52% one year earlier. As the platform becomes popular among a broader range of age groups, Roblox may stand to enjoy growth to be had from a larger total addressable market.

Roblox’s Network is Still Growing

Roblox users are growing up, but many are sticking with the platform. This shows that Roblox isn’t just some game that kids grow out of. In fact, Roblox may be more akin to Minecraft in that it can keep young gamers engaged for years, even with new, hot titles released on a consistent basis on affordable monthly-gaming subscription plans like Microsoft’s (NASDAQ:MSFT) Xbox Game Pass.

For the fourth quarter, bookings jumped 17%, while engagement rose by a similar amount, around 18%. Indeed, Roblox still seems to be in growth mode, even as it looks to encounter another recession.

As other tech companies look to aggressively cut capital spending while potentially jeopardizing growth rates, Roblox seems to be going full speed ahead on a relative basis. Even though Wall Street is enthusiastic about big budget cuts, I think Roblox is smart to keep investing in its platform at the expense of nearer-term profitability metrics.

The company must keep building its moat to shut the door on rivals like Meta Platforms. That means investing in safety protocols to keep users safe while rewarding developers for experiences that keep users engaged.

It’s tough to see when Roblox stock will turn a corner. Even if cash isn’t so free anymore, I think the firm’s growth-focused mindset will ultimately pay off down the road. Still, while the metaverse trend is still in play, investors just don’t seem nearly as willing to pay up for exposure anymore.

Is RBLX Stock a Buy, According to Analysts?

Turning to Wall Street, RBLX stock comes in as a Hold. Out of 18 analyst ratings, there are eight Buys, six Holds, and four Sell recommendations.

The average Roblox stock price target is $42.44, implying an upside of 14.8%. Analyst price targets range from a low of $21.00 per share to a high of $55.00 per share.

The Bottom Line on Roblox Stock

It’s easy to dismiss Roblox stock as shares continue to feel the heat of higher rates and the tech sell-off. Nonetheless, the company showed it’s still capable of growth amid challenging conditions in the fourth quarter.

As the firm beefs up its ecosystem, it’s easy to discount the type of profitability the firm could be capable of far into the future. The way I see it, the firm has all the building blocks (forgive the pun) to capitalize on the metaverse trend over the long run.

Even as losses pile up, I think Roblox is one of the hyper-growth plays that deserves the benefit of the doubt. At 11.1 times sales, the stock is way cheaper than it was during most of 2021 when shares went for north of 35 times sales.