- Febbraio 8, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

For the second pick, we’ll look at Rhythm Pharma, a biopharmaceutical firm moving from clinical trials to commercialization. Rhythm’s research programs focus on rare genetic conditions resulting in obesity.

Obesity is well-known as a contributing factor to numerous health issues, which helps ensure a patient base. Rhythm is working on drug candidates that will work on the melanocortin-4 receptor (MC4R) pathway, brain pathway responsible for regulating weight and hunger. As such, this pathway is considered a root cause in multiple genetically-based obesity conditions.

Rhythm currently has one product undergoing commercialization, setmelanotide, which is marketed as Imcivree. This drug received its approval from the FDA in November of 2020, and is now used to treat obesity caused by several different conditions: pro-opiomelanocortin (POMC) deficiency, proprotein subtilisin/kexin type 1 (PCSK1) deficiency, leptin receptor (LEPR) deficiency, and Bardet-Biedl syndrome (BBS). In these indications, the drug is approved for patients over the age of 6 in need of chronic weight management.

Following the approval of Imcivree for BBS, the drug saw strong demand in the November 2022 report for 3Q22, with accumulated prescriptions totaling 120. Sales of the drug totaled $4.3 million, up from $1 million in the prior-year quarter. Rhythm had a cash position at the end of the quarter totaling $347.8 million in liquid assets. This was up almost 18% y/y.

The company is working to expand the indications for Imcivree, and has several ongoing clinical trials of the drug in the treatment of additional conditions. These include a Phase 3 study of the drug for pediatric use, in patients under age 6, for the same conditions already approved in older children and adults.

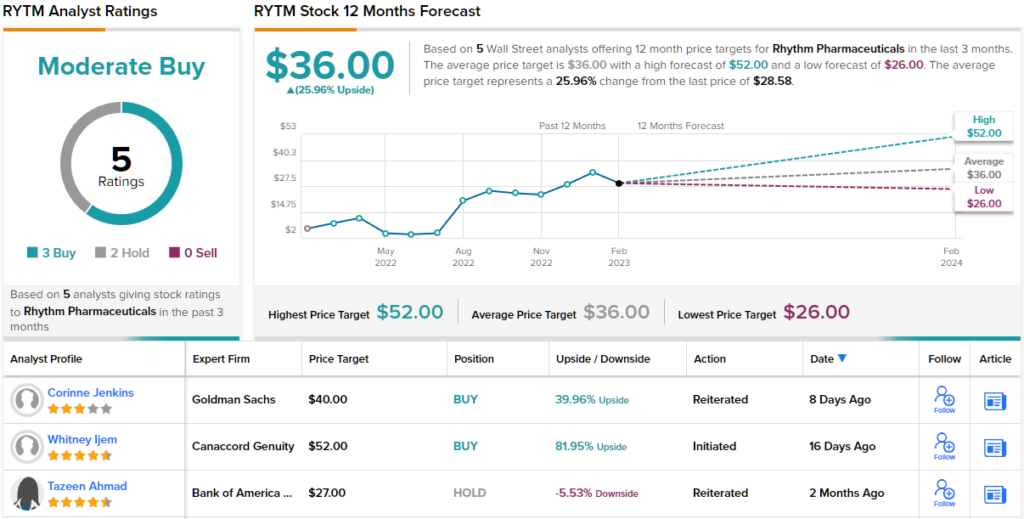

Among the bulls is Canaccord’s Ijem, who paints a positive picture of Rhythm going forward.

“Following a productive 2022, Rhythm’s Imcivree for the management of genetic obesity is positioned well headed into 2023. The launch of this product has been slightly unorthodox leading to sales expectations that we think are reasonable/beatable (we model $82M in 2023 sales vs. cons of $64).

As such, we expect quarterly updates throughout the year will help build confidence in the global commercial infrastructure that RYTM has built. Meanwhile, the company also continues execution on the clinical side as it is working to start a Ph3 trial of Imcivree in hypothalamic obesity,” Ijem opined.

These comments back up Ijem’s Buy rating on the stock, while her $52 price target indicates potential for 82% upside by the end of this year.

Overall, Rhythm has a Moderate Buy consensus rating from the Street, based on 6 recent reviews that break down 4 to 2 favoring Buys over Holds. The shares have a current trading price of $28.58 and the $36 average price target suggests ~26% upside over the next 12 months.