- Gennaio 27, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

CleanSpark, Inc. (CLSK)

The next Cantor-endorsed crypto stock is CleanSpark, another bitcoin miner. That wasn’t always the case with this company, however. CleanSpark was once just a provider of microgrid solutions and only kicked off its mining operations at the end of 2020. Since then, though, the mining activities have become the main concern, with the company now a fully-fledged bitcoin miner.

The company operates its own bitcoin mining facilities in Atlanta, Georgia and co-locates miners in Massena, NY. Although bitcoin mining is known to be extremely energy intensive, CleanSpark touts itself as a sustainable mining firm and mines mostly with renewable or low-carbon sources of energy. The company’s capital management policy involves selling a big chunk of the BTC mined, the proceeds of which go towards funding further growth. This has enabled CleanSpark to boost its hashrate from 2.1 EH/s in January 2022 to 6.2 EH/s, in December, even in the face of the industry’s difficulties.

Per the company’s recent update, its fleet of 63,700 latest-gen bitcoin miners mined 464 bitcoin in December, resulting in annual production of 4,621 – representing growth of more than 200%. The company sold 517 bitcoins in December at an average of ~$17,000/BTC, with the sales generating proceeds of ~$8.7 million.

At the same time, the company said it is reducing its CY23E hash rate outlook from 22.4 EH/s to 16.0 EH/s, due to delays in the infrastructure expansion at Lancium, where CleanSpark has signed an agreement to deploy some of its mining gear.

While the result will be less hash rate by the end of the year, Siegler views the development as a “clearing event” for the stock.

“A 16.0 EH/s target would still solidify CLSK as one of the largest, vertically-integrated, self-miners in the industry,” the analyst said. “However, we believe the company has better foresight and control over the development of its self-mining sites than the co-location infrastructure. Further, the company disclosed that its new hash rate guidance requires just ~95,000 rigs and ~$70MM of CapEx spending. Assuming rigs can be acquired at ~$15/TH, this would imply the new cost for reaching its target hash rate is ~ $212.5MM. This compares favorably to our current conservative assumption of ~$350MM and will likely result in less equity dilution.”

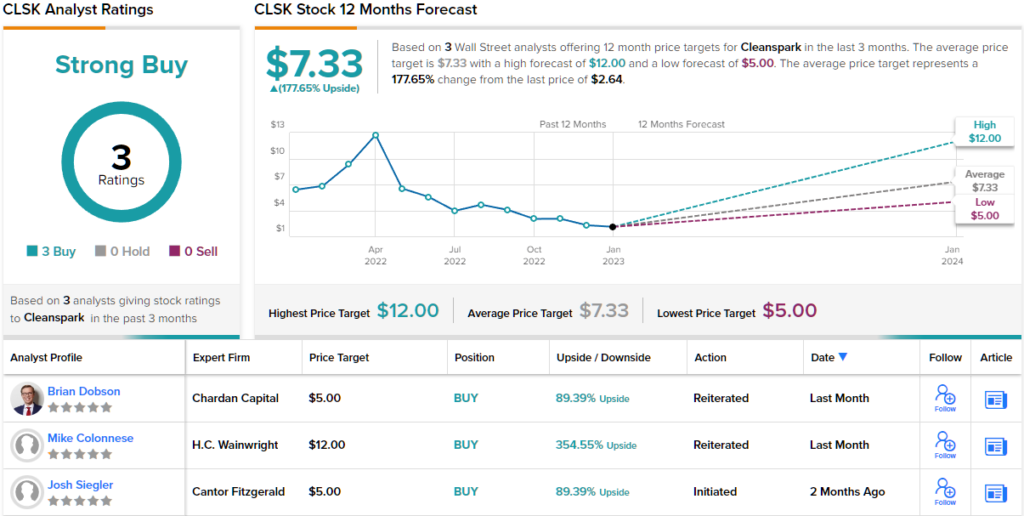

CleanSpark shares might be up by 48% since December’s trough, but Siegler thinks they have plenty more room to run. The analyst rates the stock an Overweight (i.e. Buy) along with a $5 price target. The figure makes room for one-year returns of 89%.

Two other analysts have recently waded in with CLSK reviews, and both are also positive, making the consensus view here a Strong Buy. At $7.33, the average target implies the shares will appreciate by a hefty 178% in the year ahead.