- Gennaio 10, 2023

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Shares of Alibaba have dropped more than 13% in value over the past year beating the S&P500 (SPY) which lost 17.1%.

In comparison, other Chinese stocks have fared relatively better with BABA’s peer JD.com (JD) losing only 9.3% while Pinduoduo (PDD) saw its stock rise by more than 65% in the past year.

The stock has been battered over the past year amid a broad selloff of Chinese stocks and increased regulatory scrutiny from both Chinese and U.S. regulators.

The Jack Ma-owned Alibaba has faced increasing regulatory scrutiny over the past two years. Back in 2021, it was fined $2.8 billion by China’s antitrust regulator for misusing its dominant position over its competitors and merchants on its e-commerce platforms.

Furthermore, the Chinese billionaire’s criticism of the Chinese Government back in 2020 also resulted in the scuttling of the world’s largest IPO of BABA’s affiliate, Ant Group.

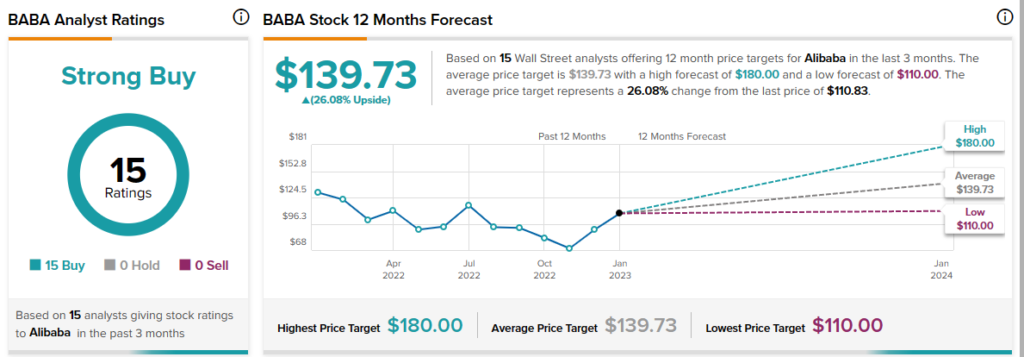

However, there are signs of improvement for BABA with the stock already up by more than 20% in the past five days.

Even Morgan Stanley analyst Gary Yu is upbeat about BABA stock with a Buy rating and price target of $150. Yu stated that investors have “underappreciated Alibaba’s leverage to a consumption recovery in China” as the company strengthens its retail leadership in consumer products categories such as apparel and cosmetics.

Moreover, the analyst also expects BABA’s cloud business to stage a growth recovery in the first quarter of next year and expects the regulatory scrutiny to ease up for BABA.

Yu also approved of Jack Ma ceding control of Ant Group and its capital raise of $1.5 billion.