- Dicembre 23, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Amazon (NASDAQ:AMZN), like several other tech stocks, has been battered this year due to macro pressures and the growing fears of a global economic slowdown. The stock might remain volatile over the near term due to rising interest rates and weak consumer spending. Nonetheless, most Wall Street analysts are bullish about Amazon’s long-term growth due to its dominance in the e-commerce and cloud computing markets.

Amazon Well-Equipped to Face Near-Term Headwinds

High inflation and recessionary fears have severely hit Amazon’s e-commerce business following a stellar run earlier in the pandemic. In the third quarter, revenue from the company’s North America segment grew 20%, while the International retail segment’s revenue declined 5%. Both segments reported operating losses in the quarter due to higher expenses.

Nonetheless, Amazon returned to profitability in Q3 due to $5.4 billion of operating income from its Amazon Web Services (AWS) cloud computing segment. The AWS segment’s revenue increased 27.5%, marking the slowest growth since 2014 due to the impact of economic pressures on the IT budgets of enterprises. Overall, AWS is showing resilience amid tough conditions and seems poised to grow once the macro challenges ease.

Also, one needs to pay attention to the company’s rapidly growing advertising business. The company’s advertising services revenue grew 25% to $9.5 billion, while several other ad-dependent companies struggled during the quarter.

Amazon’s Q4 revenue growth guidance of 2% to 8% suggests continued pressures in the holiday season. Nevertheless, the company is trying to improve its profitability by reducing costs through productivity measures, headcount reduction, and closure of unprofitable businesses.

Is Amazon Stock a Buy?

This week, JP Morgan analyst Doug Anmuth lowered his price target for Amazon stock to $130 from $145 to reflect macroeconomic pressures and the softness in the cloud business. Nonetheless, Anmuth reiterated a Buy rating as secular tailwinds for the business remain attractive. Also, he believes that the significant pullback in the stock “creates a compelling opportunity” for investors.

Anmuth added, “We believe Amazon’s flexibility in pushing first-party vs. third-party inventory and its Prime offering both serve as major advantages in its retail business, and its multi-year head start in the cloud has led to a 40%+ AWS global market share.”

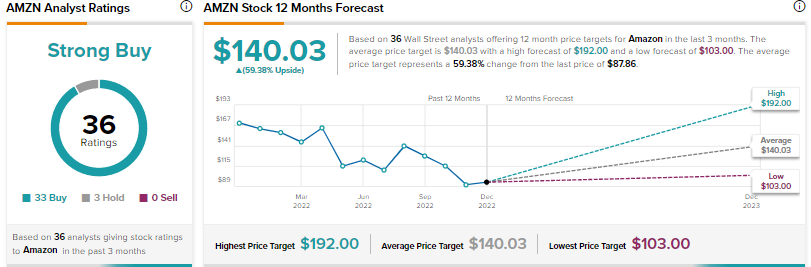

Overall, Amazon scores a Strong Buy consensus rating based on 33 buys and three Holds. The average Amazon stock price target of $140.03 implies 59.4% upside potential. AMZN stock has plunged over 47% year-to-date.

Conclusion

Macro challenges might continue to weigh on Amazon stock over the near term. However, analysts are optimistic about the tech giant’s ability to navigate these pressures and emerge stronger, backed by the long-term prospects for AWS and other high-growth areas.