- Novembre 25, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Cathie Wood has built her career on holding contrarian views and her Ark Invest firm has been known to go against the grain. As such, 2022’s bear market has done little to change her stance. In fact, recently, Wood has been arguing that the Fed’s aggressive monetary stance in its ongoing efforts to curb soaring inflation is misguided. Highlighting deflationary signals, Wood says that unless it changes tack, the Fed’s actions could result in a repeat of the the Great Depression.

“If the Fed does not pivot, the set-up will be more like 1929,” Wood opined. “The Fed raised rates in 1929 to squelch financial speculation and then, in 1930, Congress passed Smoot-Hawley, putting 50%+ tariffs on more than 20,000 goods and pushing the global economy into the Great Depression.”

Meanwhile, back in the here and now, the Fed’s policies and interest rate hikes have played havoc with the markets and have sent shares across the board tumbling, leaving many stocks looking rather cheap.

ATAI Life Sciences (ATAI)

Wood has been known to favor cutting-edge companies and the first pick certainly reflects that. ATAI is at the forefront of what could be a new paradigm in treating mental health disorders – it is testing the use of psychedelics for medicinal purposes.

The company’s business model is differentiated; it operates via a decentralized platform that purchases and runs clinical programs with small affiliate companies formed around the pipeline candidates. All can access shared funds, with the capital allocated per needs.

After discarding some of its early programs deemed superfluous, the company’s pipeline has been toned down to 8 candidates aimed at treating depression, anxiety, schizophrenia and substance abuse.

Leading the way is PCN-101/R-ketamine, indicated as a therapy for treatment resistant depression (TRD). Then there is RL-007, which targets cognitive impairment associated with schizophrenia. Both of these drugs are currently in phase 2 studies.

Further back in development, the pipeline includes GRX-917 (deuterated etifoxine), which is being developed for generalized anxiety disorder (GAD), and for which the company recently announced positive preliminary pharmacokinetics and pharmacodynamics results from a Phase 1 study. Positive preliminary results of the single ascending dose (SAD) portion of the Phase 1 testing of KUR-101 (deuterated mitragynine) indicated to treat opioid use disorder (OUD) were also recently announced.

With the shares down by 64% year-to-date, Wood has been in a buying mood. In Q3, Ark Invest splashed out on 6,133,914 ATAI shares, increasing its position by 280%. At the current share price, these are now worth $17.61 million.

With top-line data for PCN-101’s Phase 2a proof-of-concept trial anticipated before the year’s end, Canaccord analyst Sumant Kulkarni thinks the upcoming readout could dictate near-term sentiment, although the analyst also thinks those taking the long-term view will be rewarded eventually.

Kulkarni writes, “We believe it is important for the stock that PCN-101 hits the objectives. As with any neuropsychiatry trial, we are mindful of the risks, but at current levels we view the absolute dollar downside as less than the potential upside.”

“Our bigger picture thesis on the stock remains the same,” the analyst went on to add, “i.e., we continue to believe ATAI presents a potentially solid opportunity for investors (especially those who have patience and/or a longer-term focus) to participate in the underserved mental health space. Along these lines, we point to ATAI’s relatively diverse mental health-focused pipeline (with a good mix of non-psychedelic and psychedelic compounds), and cash runway into 2025E that covers some potentially meaningful catalysts.”

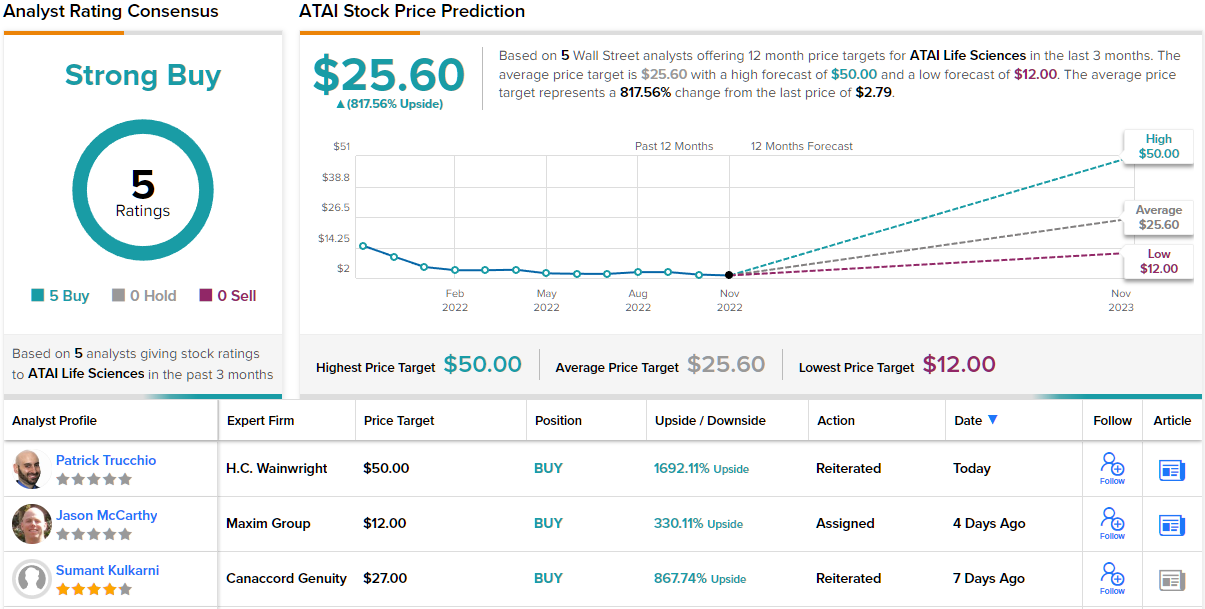

Kulkarni is evidently extremely bullish; along with a Buy rating, the analyst’s $27 price target makes room for one-year gains of an extraordinary 868%.

Kulkarni’s take is no anomaly; all current reviews – 5, in total – are positive, providing the stock with a Strong Buy consensus rating. Moreover, the average target stands at $25.60, suggesting they will climb ~818% higher over the 12-month timeframe.